Development of the TV and Online Advertising Market

The TV advertising market reflects the generally positive domestic economy in Germany. According to Nielsen Media Research, gross TV advertising investment in 2015 as a whole increased by 7.0 % to EUR 13.980 billion (previous year: EUR 13.068 billion). A large portion of the investment of EUR 4.678 billion (previous year: EUR 4.341 billion) was made in the fourth quarter, which simultaneously saw above-average growth of 7.8 %.

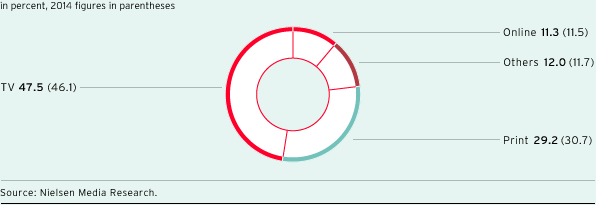

In 2015, the gross market growth was particularly due to higher TV investment in the service (+30.9 %), telecommunications (+17.1 %) and trade (+13.6 %) industries. At the same time, TV is continuing to grow in significance as an advertising medium: In the reporting period, television rose by 1.3 percentage points to 47.5 % on a gross basis. By contrast, print lost ground, with its gross share decreasing by 1.5 percentage points to 29.2 %. The gross market share of online media was virtually stable at 11.3 % (previous year: 11.5 %).

Media mix German gross advertising market

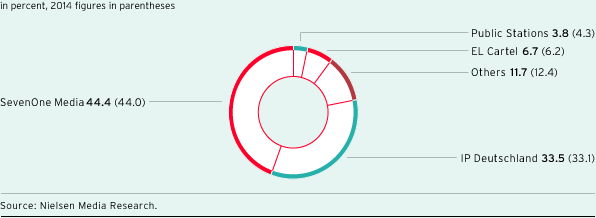

In this positive industry environment, ProSiebenSat.1 Group significantly increased its TV advertising revenues: In 2015, the Company grew by 7.8 % to EUR 6.201 billion in gross terms (previous year: EUR 5.754 billion) and thus grew stronger than the market. In the fourth quarter, which is especially important for the industry, ProSiebenSat.1 increased its TV advertising market shares by 9.6 %; the Group raised the previous year’s result from EUR 1.878 billion to EUR 2.059 billion. Against this backdrop, ProSiebenSat.1 also strengthened its lead over competitor IP Deutschland: In the fourth quarter of 2015, the Group had a market share of 44.0 %, far ahead of the marketer of the RTL Group (33.7 %). The Group also underscored its leading position with a market share of 44.4 % in 2015 as a whole (previous year: 44.0 %). Official data to the net advertising market will be published in May 2016 by the Association of German Advertisers (Zentralverband der deutschen Werbewirtschaft, ZAW). However, we assume that we have exceeded the positive market growth even on a net basis. Thus, we both expanded our new customer business and gained investment volume at the existing customer basis.

Shares German gross TV advertising market

Gross advertising spending also developed very positively in Austria and the German-speaking parts of Switzerland. In Austria, gross television advertising expenditure grew by 6.0 percentage points compared to the previous year, resulting in EUR 1.003 billion. ProSiebenSat.1 PULS 4 used the good market environment and increased its gross advertising market share to 36.9 % (previous year: 35.4 %). The market volume for Switzerland was CHF 1.237 billion (previous year: CHF 1.188 billion); this equates to growth of 4.1 percentage points. In this positive industry environment, the television advertising revenues of ProSiebenSat.1 Schweiz also increased; its gross market share rose to 28.9 % (previous year: 25.7 %).

Development of the relevant TV advertising markets for ProSiebenSat.1 Group |

||||||||||||||

|

|

|

|

|

||||||||||

|

Change against previous year |

|||||||||||||

in percentage points |

Development of |

Market share of |

Development of |

Market share of |

||||||||||

|

||||||||||||||

Germany |

7.8 |

0.8 |

7.0 |

0.3 |

||||||||||

Austria |

4.5 |

2.2 |

6.0 |

1.5 |

||||||||||

Switzerland |

6.9 |

4.2 |

4.1 |

3.2 |

||||||||||

Nielsen Media Research designates gross figures for the online advertising market in Germany, excluding among others Google/ YouTube, Facebook.

According to Nielsen Media Research the advertising market for in-stream video ads is continuing to develop very dynamically in Germany: In 2015, the market volume grew by 30.5 % year-on-year to EUR 496.9 million on a gross basis (previous year: 380.8 million). In-stream video ads are forms of Internet video advertising shown before, after or during a video stream. By selling them, ProSiebenSat.1 Group generated gross revenues of EUR 214.7 million in the past financial year (previous year: EUR 184.5 million). This corresponds to a year-on-year increase of 16.4 % and a gross market share of 43.2 % (IP Deutschland: 32.7 %). Overall, investments in online forms of advertising rose by 2.5 % to EUR 3.328 billion (previous year: EUR 3.347 billion). In addition to in-stream videos, the online advertising market also includes display ads such as traditional banners and buttons.

1 Gross advertising expenditure allows only limited conclusions to be drawn about actual advertising revenues as it does not take into account discounts, self-promotion or agency commission. In addition, the gross figures from Nielsen Media Research also include TV spots from media-forrevenue- share and media-for-equity deals, which ProSiebenSat.1 does not assign to the Broadcasting German-speaking segment but rather to the Digital & Adjacent segment.