Strategy and Management System

- ProSiebenSat.1’s primary goal is to grow profitably and sustainably. By 2018, consolidated revenues are supposed to increase by EUR 1.85 billion compared to 2012. This is EUR 850 million more than originally planned.

- With our three strategic growth areas, we want to achieve our targets and make our vision of a broadcasting, digital entertainment and commerce powerhouse a reality.

- Like planning, Group management is performed centrally via the Executive Board of ProSiebenSat.1 Media SE. It has adopted performance indicators for all relevant targets.

- Our management system is comprehensive and therefore reflects the interests of equity providers and lenders as well as the overriding growth targets. This includes efficient financial planning and an earnings-oriented dividend policy.

Corporate Strategy and Vision

ProSiebenSat.1 pursues a dual strategy: The Company is market leader in the high-revenue TV market of Germany and generates growth on the basis of its high reach — both in the core segment and digital entertainment field. At the same time, we use TV advertising as an investment currency and cross-promotion tool in the digital commerce sector. We are so successful with this strategy that we have not only achieved our past financial targets, but in many cases exceeded them. Its reach also offers ProSiebenSat.1 the opportunity to promote products to an audience of millions at low financial costs. Thus, ProSiebenSat.1 is creating new growth areas and continuously increasing the value of the Company. This makes ProSiebenSat.1 a growth stock with an attractive dividend yield.

Value Creation and Vision

The high reach, many years of experience in video marketing and close relationships with the film industry are the foundations for ProSiebenSat.1 Group’s success in the TV business. At the same time, this is the basis of our digital strategy:

- The areas of television and digital entertainment complement each other synergistically. In recent years, the Company has strongly diversified the utilization of its program content by establishing new digital entertainment offerings. At the same time, ProSiebenSat.1 increases the overall reach of its TV and digital platforms with external distribution partnerships. We are therefore not only consistently creating new sources of revenues. Programs with a multi-screen approach increase audience engagement, and campaigns disseminated via various media, from TV and online to mobile, are proven to achieve a greater advertising impact. With its portfolio, the Company serves all modern forms of media use and covers the entire value chain of TV and digital entertainment: from development through production and advertising marketing to distribution via the Group’s and third parties’ platforms.

- Technological change and the rising use of the Internet are not only influencing media usage behavior. Digitalization is affecting nearly every industry; consumer behavior in general is changing. This trend is creating new commercial business models in the field of e-commerce, as the sale of products and services via the Internet is growing dynamically. This offers ProSiebenSat.1 high potential for enhancing the entire value chain with investments in e-commerce enterprises. The Group has clear competitive advantages here. ProSiebenSat.1 is using TV reach as an additional currency and is also diversifying its value chain vertically: The Company grants free TV advertising space in return for a share in the revenues or equity (media-for-revenue-sharfe/media-for-equity) to start-up businesses and is thus able to expand its portfolio without making high cash investments. Furthermore, ProSiebenSat.1 uses free TV advertising time to increase awareness of commerce products and to built up new brands. Thereby, ProSiebenSat.1 realizes synergies both between the investments and value-creation processes (intersynergies) and within the ‘verticals’ (intrasynergies). ProSiebenSat.1 uses ‘vertical’ to describe a portfolio of companies that complement each other thematically on the basis of its offerings. One example is the Group’s travel portfolio, which covers the entire travel-booking cycle and other offers such as a weather portal.

ProSiebenSat.1 Media SE measures the success of its strategy by the revenue and earnings increase in the three segments Broadcasting German-speaking, Digital & Adjacent, and Content Production & Global Sales. In the mid-term, Group revenues are expected to increase by EUR 1.85 billion to approximately EUR 4.2 billion by 2018 compared to 2012. Originally, a EUR 1 billion increase to nearly EUR 3.4 billion by 2018 was envisaged. Recurring EBITDA is expected to rise by EUR 350 million compared to 2012 to nearly EUR 1.1 billion in 2018. In recent months, ProSiebenSat.1 grew faster and more strongly than expected in all segments. The digital sector is developing particularly dynamically; already from 2011 onwards, external revenues in the Digital & Adjacent segment have grown by an average of 39 %. In 2018, the segment is expected to make a profitable revenue contribution of EUR 1.2 billion. Overall, the Company is planning to generate around half of its revenues outside of the classic TV advertising business by then. These financial goals reflect our vision: We will establish ProSiebenSat.1 Group as a leading broadcasting, digital entertainment and commerce powerhouse.

Strategic Areas of Action

Our value creation is focused on sustainable and profitable growth. We have defined three strategic fields of action for achieving our financial targets:

1. Strengthening the core business: ProSiebenSat.1 Group is growing highly profitably in its TV segment Broadcasting German-speaking with a recurring EBITDA margin of over 30 %. In the core business, we benefit in the audience and advertising market from the fact that we have purposefully expanded our complementary station family in recent years and now reach nearly all demographic target groups: While SAT.1 offers programs for the whole family, ProSieben is primarily aimed at young viewers aged between 14 and 39. The core target group of kabel eins is viewers between 14 and 49 years old. sixx focuses on younger women aged between 14 and 39. SAT.1 Gold is mainly aimed at women from 40 to 64 years. ProSieben MAXX chiefly appeals to male viewers between 14 and 39 years old. Since October 2015, the stations offered by ProSiebenSat.1 in Switzerland have also included Puls 8; the full service broadcaster is aimed at 20- to 49-year-old viewers. In total, ProSiebenSat.1 Group operates eight free TV stations and twelve advertising or program windows in the German-speaking region and will carry on its complementary channel strategy. ProSiebenSat.1 Group invests around EUR 900 million per year in programming assets and will continue to expand its station network in the future. The objective is to create new spaces for advertising customers. Our Group is achieving this by identifying relevant target groups that are not yet represented or are currently under-represented in the TV market and conceptualizing corresponding television stations. We are thus successfully obtaining new customers — especially from the print segment. Our free TV stations are marketed by the subsidiaries SevenOne Media and SevenOne AdFactory. The companies support advertising customers and agencies from idea generation and conception to the implementation of campaigns on TV and digital platforms and offer cross-media marketing concepts that involve all video media. Via the use of innovative technologies, the Group has also secured a sustainable position in the marketing business and for making forays into new markets. These include the issues of addressable TV, targeting, and entering the marketing of external digital spaces.

A second and increasingly important source of revenues besides TV advertising is distribution. Here, the Company participates in revenues that providers generate from the distribution of HD channels. These include technical service fees that cable network, satellite, and IPTV operators raise for the distribution of free TV stations in HD quality and in which ProSiebenSat.1 Group takes a share. The Group also operates three basic pay TV channels: SAT.1 emotions, ProSieben FUN, and kabel eins CLASSICS. ProSiebenSat.1 Group has therefore established business areas with long-term recurring revenues that are independent of the advertising market. For 2018, we expect revenue growth of EUR 375 million compared to 2012 in the Broadcasting German-speaking segment; around EUR 100 million of these revenues is set to come from distribution.

Red Arrow Entertainment Group complements the value chain relating to the core business of TV: Red Arrow develops, produces and distributes TV formats for ProSiebenSat.1 Group stations and for third parties. In 2015, Red Arrow sold TV formats in more than 200 countries; the company’s program catalog currently contains more than 800 titles. The strategic focus is on expansion in the Anglo-American region and the development of the English-language fiction portfolio, as this is in particularly high demand internationally. The company’s customers include TV corporations as well as digital platforms with a multinational presence such as Amazon and Netflix. This gives Red Arrow access to a dynamically growing procurement market. Red Arrow is consolidated in the Content Production & Global Sales segment. By 2018, we expect revenues in this segment to rise by EUR 275 million compared to 2012; Red Arrow already achieved the original growth target of EUR 100 million in 2014.

2. Expansion of the digital entertainment portfolio: ProSiebenSat.1 has also established a far-reaching brand portfolio in the digital sector, with which we reach more than 30 million unique users per month in Germany alone. This is based on the strong TV brands and their content, which we extend and distribute synergistically via digital platforms. At the same time, we are developing and producing exclusive content for our digital entertainment portfolio in order to increase the attractiveness of our brands, e.g. for the multi-channel network (MCN) Studio71. Our digital entertainment offerings cover all relevant value-creation streams via the marketing of advertising space, pay-per-view videos and subscription models. With online portals, streaming services such as the 7TV app, the MCN, mobile offerings and the video-on-demand (VoD) platform maxdome, the Group is participating in the dynamic development of digital markets, enhancing its revenue profile, extending its reach and generating growth outside of the traditional TV advertising business. The digital entertainment offerings are bundled in the Digital & Adjacent segment.

3. Investment in markets with high growth potential: The third strategic field of action is derived from the growth of certain markets and our market share in the core business of television: With its free TV activities, ProSiebenSat.1 Group operates in a market environment with solid growth and runs a highly profitable business with strong cash flow. However, the Group’s strategic goals include tapping into new, dynamically growing markets. For this reason, ProSiebenSat.1 Group is also expanding its portfolio vertically by way of investments. The Group is most actively pursuing this goal via its Ventures & Commerce activities, which provided the highest growth contribution in financial year 2015.

ProSiebenSat.1 pursues various M&A approaches. One way is to acquire majority interests. Here, the Company firstly has realized larger aquisitions. In addition to Verivox, etraveli was a major acquisition in the digital sector. etraveli was already one of the leading pan-European online air travel agencies when purchased and augments our existing Travel Vertical. Travel portals are well suited to TV advertising because of their visually captivating subject matter. For example, the revenues of billiger-mietwagen.de and mydays grew by more than 20 % after integration into the ProSiebenSat.1 portfolio and marketing on TV. This market is growing by a mid to high single-digit percentage rate. ProSiebenSat.1 is developing other verticals according to this model and increasingly realizing revenue and cost synergies between the investments. Besides Digital & Adjacent, a second M&A focus was on the Content Production & Global Sales segment.

In addition to traditional acquisitions and majority interests, ProSiebenSat.1 also takes a share in the value creation of smaller firms or businesses in an early stage of development via the media-for-revenue-share and media-for-equity models. This approach has the advantage that portfolio measures involve much less uncertainty with regard to value or integration. At the same time, these companies benefit in particular from seed funding via media services and marketing on our far-reaching platforms. In addition, the Group often acquires a minority share in the first stage in order to minimize risks. In 2015, for example, ProSiebenSat.1 invested in online shops such as Flaconi and used advertising to considerably increase the portals’ page views and name recognition. Once sure that the described marketing mechanisms were successful, the Group topped up its shares in these investments and integrated the acquired companies into its portfolio, increasing its value. Flaconi, for example, complements the Beauty & Accessories Vertical and, in addition to the marketing through ProSiebenSat.1 platforms, benefited from the Group’s know-how as market leader for video advertising and its central infrastructure, such as controlling services and HR management.

Reach is the common denominator and crucial competitive advantage of our M&A strategy: With free advertising time of more than EUR 1.5 billion a year in gross terms, ProSiebenSat.1 has a second relevant investment currency. Through advertising on its own platforms, ProSiebenSat.1 can rapidly increase brand recognition without high costs. At the same time, the Group covers some of its investment requirements with media services and therefore requires less cash for acquisitions. The shareholders benefit from these financial advantages — despite investments, the Company can distribute 80 % to 90 % of underlying net income every year. This makes the ProSiebenSat.1 share a strong growth driver in the MDAX.

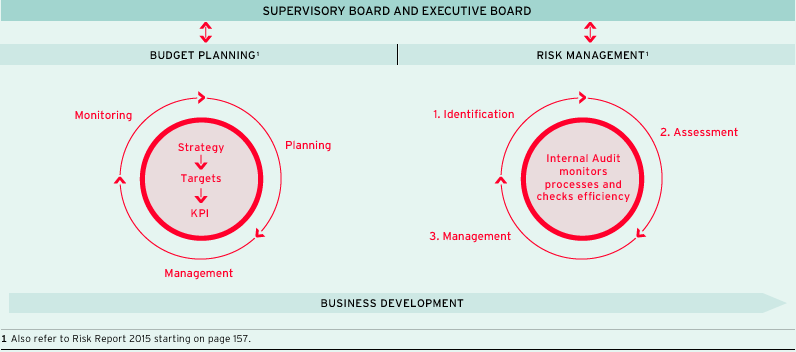

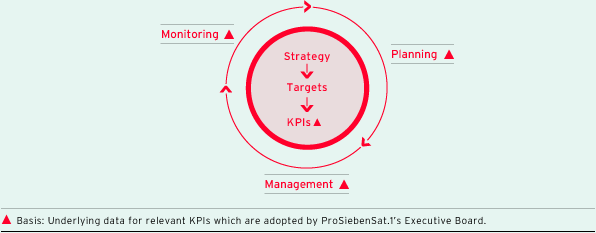

Planning and Management

Our financial and strategic decisions are based on the development of Company-specific key figures. These financial and non-financial key performance indicators (KPIs) emerge from the corporate strategy; they are planned and managed centrally by the full Executive Board of ProSiebenSat.1 Media SE. The planning and management process is complemented by the monitoring of the KPIs on the basis of regularly updated data. This includes the assessment of developments within the framework of opportunity and risk management.

Intragroup Management System

Intragroup Management System

The performance indicators specific to ProSiebenSat.1 are aligned to the interests of the capital providers and cover financial planning as well as aspects of comprehensive revenue and earnings management. The following illustration provides an overview of our management system:

Overview of relevant key performance indicators |

||

|

|

|

Non-financial performance indicator |

Broadcasting German-speaking segment |

|

Financial performance indicators |

Group |

|

- Non-financial performance indicators: ProSiebenSat.1 Group has a broadly diversified portfolio; its operating key figures are accordingly diverse. The central and decisive non-financial indicator for the core business is the audience share of the free TV stations.

Data on TV consumption in Germany is collected by GfK Fernsehforschung on behalf of the Arbeitsgemeinschaft Fernsehforschung (AGF). In addition to traditional linear television consumption, the usage of video offerings online and — in the future — through mobile devices is being integrated here. We evaluate the data collected by the institutes on a daily basis; we analyze both the performance of the stations in the target group of 14 to 49 year old viewers that the advertising industry is interested in and in their respective relevant target groups. This is the basis for our successful program planning. At the same time, the data are of central importance for the financial calculation of prices for advertising time: The development of audience shares documents the popularity of shows with the public and thus the reach of advertising spots.

- Financial performance indicators: The key indicators for managing profitability are the generated revenues and the recurring EBITDA. Recurring EBITDA stands for recurring earnings before interest, taxes, depreciation and amortization. Non-recurring income and expenses are not included, so that this key figure reflects the operating profitability of the Group and its business entities or segments in a meaningful way.

The underlying net income also measures the Group’s operating performance. The underlying net income represents the adjusted consolidated net profit after non-controlling interests from continuing activities; the effects of purchase price allocations and other special items are not taken into account when it is calculated. The payout ratio for dividends of ProSiebenSat.1 Media SE is calculated on the basis of the Group’s underlying net income. We are pursuing a profit-oriented dividend policy with the aim of distributing 80 % to 90 % of underlying net profit each year.

Non-recurring and special items can influence or even overshadow the performance and can make a multi-year comparison difficult. However, the analysis of unadjusted key earnings figures enables a holistic view of the expense and income structure. For this reason, ProSiebenSat.1 Group also uses EBITDA as a control parameter for profitability. In addition, EBITDA makes it easier to compare assessments internationally, as it does not take into account the effects of taxes and impairments or the financing structure. Internally, EBITDA serves both at Group level and for the segments as an important performance indicator and has become more relevant for the Digital & Adjacent segment in particular in recent years. The segment is growing dynamically; most recently, it generated 26.0 % of total annual revenues (previous year: 21.2 %) and 16.9 % of Group EBITDA (previous year: 15.1 %).

ProSiebenSat.1 Group invests in markets with long-term growth opportunities and examines options to expand its portfolio. The acquisition of companies that complement our value chain synergistically is part of this strategy. Capital-efficient financial leverage (leverage ratio) is an important performance indicator used in the Group’s financial planning. The leverage ratio indicates the level of net debt in relation to LTM recurring EBITDA — i.e. the EBITDA adjusted for non-recurring items that ProSiebenSat.1 Group has generated in the last twelve months (LTM = last twelve months). The target is a factor of between 1.5 and 2.5.

Our corporate strategy is designed for sustainable and profitable growth. A primary goal is therefore to increase the above earnings figures through continuous revenue growth in all segments. The business entities largely function as profit centers: This means they act with full revenue and earnings responsibility. At the same time, the associated flexibility is an important requirement for the success of ProSiebenSat.1, as the Company operates in a dynamic industry environment and is consistently diversifying its value chain. The organizational entities make operating decisions required by the respective competitive environment independently within the centrally approved framework. This performance-based approach encourages our employees on all levels to act in an entrepreneurial manner.

All employees of our Company help to develop ProSiebenSat.1’s strengths and promote innovations with their knowledge and ideas. We therefore invest consistently in human resources development, support junior staff in a targeted manner, and simultaneously give all employees an adequate share in the Company’s success. EBITDA is therefore not only an important performance indicator for the management of the Group and its segments, but is also part of the performance-related compensation system for employees. Additionally to net debt, the Company’s EBITDA and external revenues and EBITDA of the Digital & Adjacent segment also serve as a variable basis for the assessment of the compensation of the Executive Board. By harmonizing the Executive Board’s compensation with our KPIs for corporate management, we implemented a holistic and effective control system which reflects the Company-specific characteristics. Further information about individual compensation of Executive Board members can be found in the Compensation Report, while the basics of reporting principles are explained in the chapter “Explanatory Notes on Reporting Principles.”

Operational and Strategic Planning

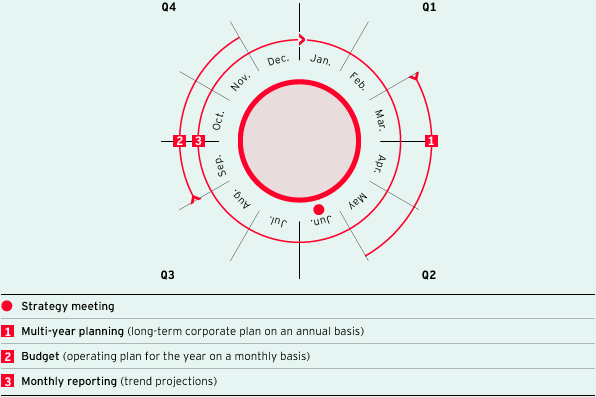

Management and planning are closely intertwined at ProSiebenSat.1: As part of planning, target figures are defined and stipulated for different time periods. The focus is on the key performance indicators described above.

The diagram below shows the individual planning levels over time for financial year 2015. The different levels in the planning process — strategic planning, multi-year planning, budget preparation, and monthly reporting — build on each other and are closely linked to our risk management. In 2015, this multi-stage process was relaunched. Multi-year planning is now performed parallel to strategic planning. The objective was to coordinate time horizons and content even more closely.

Planning calendar

- Strategy meeting: Analyses of strengths and weaknesses are important strategic planning instruments. Market conditions and current key figures for relevant competitors are compared, the Company works out its own strengths, opportunities and risks are assessed, and growth strategies are developed adequately. The Executive and Supervisory Boards discuss the results once a year in a strategy meeting.

The Group has been pursuing a consistent digital strategy for several years with the aim of strengthening the core business and simultaneously expanding the Company as a broadcasting, digital entertainment and commerce powerhouse. This course has not changed for 2015, but certain targets were prioritized and redefined at the strategy meeting. The strategy meeting for 2015 took place in June; the Group raised its medium-term growth targets in October on its Capital Markets Day. - Multi-year planning (long-term corporate plan on an annual basis): Multi-year planning constitutes the detailed, quantitative depiction of strategic planning. It is performed on a quarterly basis and contains targets for a five-year period. The relevant key financial figures from the income statements or statements of financial position and cash flow statements of individual subsidiaries are analyzed and aggregated at segment and Group level.

- Budget (operating plan for the year on a monthly basis): In turn, multi-year planning forms the basis for the budget. The budgeted figures are also calculated in a bottom-up process, but the targets for individual financial and non-financial performance indicators are specified on a monthly basis.

- Monthly reporting and trend projections: Trend projections are an important tool in planning during the year. They allow the Company’s expected performance for the year to be calculated on the basis of the targets achieved to date and to be compared with the target figures that were originally budgeted. The aim is to identify potential discrepancies between the target and actual figures immediately and to implement the necessary countermeasures promptly.

Again in 2015, the Executive Board discussed the achievement of the short-term and long-term targets together with the Supervisory Board. Apart from the monthly reporting, potential risks are reported to the Group Risk and Compliance Officer on a quarterly basis. In particular, any changes to the early warning risk indicators during the year and over time are analyzed here. For example, the development of audience shares is an important early warning indicator. Additional growth opportunities and therefore potential positive deviations from projected targets are analyzed in parallel with risk management; they are taken into account in budget planning.

Opportunity and Risk Management at ProSiebenSat.1