The ProSiebenSat.1 Share

1 This section is part of the audited Combined Management Report.

- The ProSiebenSat.1 share registers a 34.3 % share price gain and is one of the top securities in the MDAX with a dividend yield of 4.6 % on the basis of the year-end price 2014.

- The positive outlook for the year 2015 and the good performance of the company drive the value of ProSiebenSat.1 share to a record level.

- The share ranks place 2 in the MDAX; the majority of analysts recommend the ProSiebenSat.1 share as a buy.

- The Annual General Meeting agrees to SE conversion and for 2014 resolves dividends of EUR 1.60 per share entitled to a dividend.

Development of Stock Markets

After a strong performance in the first quarter, high volatility characterized the German stock market over the rest of 2015. In addition to the strong level of private consumer spending, a positive impact arose in particular from the expansionary monetary policy of the European Central Bank (ECB). Favorable financial conditions via low interest rates combined with a weak euro also pushed exports. However, German stock market prices were negatively impacted by attacks as in Paris, geopolitical developments and in particular by ongoing conflicts in Ukraine and Syria. There was also a negative impact arising from the economic situation in major emerging markets such as China and from the uncertainty with regard to the imminent key interest rate hike by the Federal Reserve. In the eurozone, the Greek sovereign debt crisis also led to temporary share price declines.

These interlinked factors resulted in strong price fluctuations in 2015: In the course of the year, the DAX fluctuated between an all-time high of 12,374.73 points on April, 10 2015 and a lowest value of 9,427.64 points on September 24, 2015. This represents a price difference of approximately 25 %. Despite the aforementioned geopolitical uncertainties, the DAX closed the trading year at 10,743.01 points and with an increase of 9.6 % on the final trading day of 2014. The MDAX developed even more positively: It closed with 20,744.62 points and a rise of 22.7 % compared to the previous year. The relevant sector index for European media stocks, the EURO STOXX Media, also performed favorably with an increase of 7.5 % and 234.94 points as of the end of year.

In 2015, the Group met its funding requirements particularly via banks and the bond market. More information on its financing structure can be found in the chapter “Borrowings and Financing Structure”.

ProSiebenSat.1 on the Capital Market

The ProSiebenSat.1 share recorded a 34.3 % share price gain compared to the end of 2014. As such, the share substantially outperformed the comparative indices again. The share reached its highest closing price of EUR 50.70 on November 19, 2015. At the same time, with market capitalization of the free float totaling EUR 10.214 billion on December 30, 2015, ProSiebenSat.1 is one of the top 30 listed stock corporations in Germany in the Prime Standard.

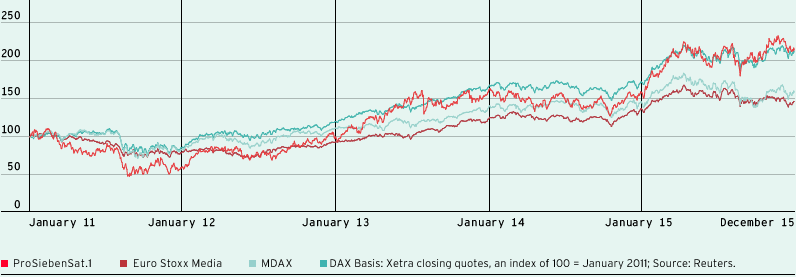

Price performance of the ProSiebenSat.1 share

Overall, the ProSiebenSat.1 share developed positively. After the share was characterized by a continuous upward trend until the end of April, it posted a more volatile performance as the year progressed due to geopolitical uncertainties and their impact on the German stock market: In late July, the share benefited from the entity’s good half-year figures and the positive outlook for the year as a whole. Discussions on a possible change in the structure of the US broadcasting sector led to significant price declines for US media stocks in August and also had a negative impact on the performance of the ProSiebenSat.1 share. Nevertheless, the share held its ground in a difficult market environment and significantly advanced once again until mid-November. The ProSiebenSat.1 Capital Markets Day in October also contributed to this, when the Group announced the increase in its original revenue growth targets until 2018 from EUR 1 billion to EUR 1.85 billion. In addition, the release of the good results for the third quarter and the positive outlook of the fourth quarter supported this price development from late October onwards. At the end of the year, the weaker stock market indices characterized the share price of the ProSiebenSat.1 share. This was mainly due to economic uncertainties in China and the low price of oil.

ProSiebenSat.1 share: Basic data |

||

|

|

|

Name |

ProSiebenSat.1 Media SE |

|

Type of share |

Registered common share |

|

Stock exchange listing |

Frankfurt Stock Exchange: Prime Standard/regulated market |

|

Sector |

Media |

|

ISIN |

DE000PSM7770 |

|

WKN |

PSM777 |

|

On the basis of the year-end price 2014 and a dividend payment of EUR 1.60 per entitled share, the dividend yield amounted to 4.6 %. The total shareholder return amounted to 39,03 % per ProSiebenSat.1 share in 2015. It was therefore above the relevant comparative levels of the DAX (9.6 %) and the MDAX (22.7 %), which also take into account the total shareholder return.

ProSiebenSat.1 share: Key data1 |

||||||||||||||||||||

|

|

|

|

|

|

|

||||||||||||||

|

|

2015 |

2014 |

2013 |

2012 |

2011 |

||||||||||||||

|

||||||||||||||||||||

Share capital at reporting date |

Euro |

218,797,200 |

218,797,200 |

218,797,200 |

218,797,200 |

218,797,200 |

||||||||||||||

Number of common shares as of end of reporting period |

Units |

218,797,2002 |

218,797,2002 |

218,797,2002 |

109,398,600 |

109,398,600 |

||||||||||||||

Number of preference shares as of end of reporting period |

Units |

–/– |

–/– |

–/– |

109,398,6002 |

109,398,6002 |

||||||||||||||

Free float market capitalization at end of financial year (according to Deutsche Börse) |

EUR m |

10,214 |

7,271 |

6,024 |

4,660 |

3,089 |

||||||||||||||

Close at end of financial year (XETRA) |

Euro |

46.77 |

34.83 |

36.00 |

21.30 |

14.12 |

||||||||||||||

High (XETRA) |

Euro |

50.70 |

35.55 |

36.00 |

23.83 |

24.80 |

||||||||||||||

Low (XETRA) |

Euro |

33.31 |

28.35 |

21.85 |

14.19 |

11.49 |

||||||||||||||

Dividend per entitled common share |

Euro |

–/–3 |

1.60 |

1.47 |

5.63 |

1.15 |

||||||||||||||

Dividend per entitled preference share |

Euro |

–/– |

–/– |

–/– |

5.65 |

1.17 |

||||||||||||||

Total dividend |

EUR m |

–/–3 |

341.9 |

313.4 |

1,201.4 |

245.7 |

||||||||||||||

Underlying earnings per share4 |

Euro |

2.19 |

1.96 |

1.60 |

1.97 |

3.23 |

||||||||||||||

Dividend yield on basis of closing price |

% |

–/–3 |

4.6 |

4.1 |

26.5 |

8.3 |

||||||||||||||

Total XETRA trading volume |

Million units |

158.9 |

179.9 |

170.0 |

134.1 |

233.4 |

||||||||||||||

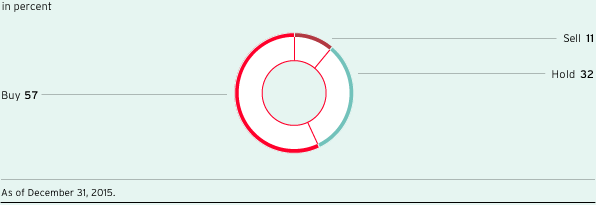

Against this backdrop, the majority of analysts (57 %) recommended the ProSiebenSat.1 share as a buy at the end of 2015; 32 % came out in favor of holding the share and 11 % made a sell recommendation. The analysts’ median price target was EUR 51 at the end of the year (previous year: EUR 38). Overall, 28 brokerage firms and financial institutions actively analyzed the ProSiebenSat.1 share and published research reports at the end of the year under review. For institutional investors in particular, recommendations by financial analysts are an important basis for decision-making.

Analysts' recommendations

ProSiebenSat.1 Media SE is the second highest weighted share in the MDAX. As of December 31, 2015, the weighting in the MDAX amounted to 6.5 %. This is calculated on the basis of market capitalization by free float and trading volume in the last twelve months. The index comprises 50 Prime Standard shares from traditional sectors that follow the 30 companies in the DAX in terms of market capitalization and trading volume. The EURO STOXX Media sector index pools stocks from media and media-related entities. ProSiebenSat.1 Media SE is represented here with a weighting of 9.2 %.

Selected index data |

||||

|

|

|||

Index |

Weighting |

|||

|

||||

MDAX |

6.46 % |

|||

Mid Cap |

4.85 % |

|||

Prime All Share |

0.83 % |

|||

Classic All Share |

4.05 % |

|||

EURO STOXX Media |

9.23 % |

|||

Annual General Meeting for Financial Year 2014

The Annual General Meeting of ProSiebenSat.1 Media AG for financial year 2014 was held on May 21, 2015. Around 450 shareholders, shareholder representatives and guests took part in the Annual General Meeting. Attendance was around 42 % of the share capital. The Annual General Meeting approved all resolutions proposed by the Executive Board and the Supervisory Board with a large majority. With 99.97 % of the votes, ProSiebenSat.1 Media AG shareholders resolved to convert the entity into a European Stock Corporation (Societas Europaea, SE) at the Annual General Meeting, the conversion was entered in the commercial register on July 7, 2015. This resulted in no material changes in corporate governance structure; shareholders’ rights in particular were unaffected. In addition, the listing of the shares on the previous stock exchanges persists.

Shareholders also approved the distribution of a dividend of EUR 1.60 per share for financial year 2014. This corresponds to a total payout of EUR 341.9 million and a payout ratio of 81.6 % of the Group’s underlying net income. Following the Annual General Meeting, the newly constituted Supervisory Board elected Dr. Werner Brandt as Chairman and Dr. Marion Helmes as his Deputy.

Information about share holdings that exceed 10 % of the voting rights can be found in Note 40 “Group affiliation and disclosures on voting rights notifications as per Section 21 (1) German Securities Trading Act (WpHG)”.

Shareholder Structure of ProSiebenSat.1 Media SE

The shareholder structure has been virtually unchanged since December 31, 2014. The shares are mostly held by institutional investors in the US,, the UK and Germany. In total, 97.9 % were held in free float as of December 31, 2015 (December 31, 2014: 97.6 %). The remaining 2.1 % are held as treasury shares (December 31, 2014: 2.4 %).

Shareholder structure of ProSiebenSat.1 Media SE as of December 31, 2015 |

||||||||||||

|

||||||||||||

|

||||||||||||

|

|

|

|

|

||||||||

Free float |

|

ProSiebenSat.11 |

||||||||||

|

|

|

|

|

||||||||

97.9 % common shares |

|

2.1 % common shares |

||||||||||

|

|

|

|

|

||||||||

ProSiebenSat.1 Media SE2 |

||||||||||||

|

||||||||||||

Capital Market Communication

We regularly provide information on all key events and developments at ProSiebenSat.1 to ensure the transparent communication of financial figures and our growth prospects. All relevant corporate information is published promptly, including on an ad-hoc basis where appropriate, in German and English on our website www.ProSiebenSat1.com. Another channel which the Group uses to provide comprehensive information to the capital market is press conferences and events for investors and analysts. In addition to 21 roadshows, ProSiebenSat.1 was represented at 20 investor conferences in Europe and the US in 2015. Another important event is the annual Capital Markets Day in October, where the Group reports on its growth strategy. The Investor Relations activities are complemented by the ProSiebenSat.1 investor hotline.

Several awards attest to the high-quality content of ProSiebenSat.1’s Annual Report and to the entity’s transparent financial communication. ProSiebenSat.1 Media SE took second place in the MDAX category in the “2015 German Investor Relations Awards.” In the “IR Professionals — MDAX” category, Dirk Voigtländer, Head of Investor Relations, ranked first. The award was presented by Thomson Reuters Extel, WirtschaftsWoche and the German Investor Relations Association (DIRK). The Group came first in the “Investors’ Darling” competition of Manager Magazin in the MDAX category. In “the best annual report” competition, ProSiebenSat.1 was also awarded first place among MDAX entities for the third time in a row. The Group was ranked second in the overall evaluation across all stock market indices. In the overall ranking of all stock market indices the Group achieved the second place.