Company Outlook

- We expect to continue our profitable revenue growth in all three segments and increase consolidated revenues by more than ten percent.

- The Digital & Adjacent segment contributes the highest growth share for our medium-term targets until 2018 with the very dynamic Ventures & Commerce business.

- In addition to ongoing economic stimuli, we base our forecast on the success of our dual strategy.

Basis of the Forecast

Planning assumptions. According to the ifo Institute’s forecast, Germany remains on course for stable growth due to the ongoing positive consumer climate. The generally positive economic prospects are likely to lead to another increase in spending on TV and online advertising; digital commerce is also expected to keep growing and maintain its momentum in a solide economic environment. Against this backdrop, we are again expecting growth of 2 % to 3 % for the German TV advertising market, which is our largest revenue market. Our planning is therefore somewhat more conservative than the research institutes’ forecasts. We expect to grow in line with the market. Alongside the volume of investment in advertising, an important planning assumption is the success of our stations. We therefore take the development of our shares in the audience market into account in our business planning. The German station family has concluded 2015 with the highest audience share in ten years. We assume that we will be able to consolidate our leading market position at a high level, but do not rule out a slight decrease in ratings for 2016. In the upcoming year are two major sporting events, which are primarily broadcast by the public stations. At the same time, increasing prices for TV advertising are likely to be realized. The fragmentation of media usage means that television’s high reach is becoming increasingly valuable for advertisers. Our newer stations in particular are increasingly able to better capitalize on their reach. This also applies to our digital platforms.

Explanatory notes on the forecast. There are framework agreements in place with a large number of our advertising customers in the Broadcasting German-speaking segment, which stipulate certain order volumes and the conditions underlying these. Advertising customers use the program preview as an important basis for making decisions about their advertising investments for the subsequent months. In so-called program screenings, ProSiebenSat.1 Group informs its customers about the strategy of the station planning as well as planned formats twice a year. As is customary in this business, the final budgets are confirmed on a month-by-month basis, sometimes in the very short term. Only then is the full volume transparent. Furthermore, additional advertising budgets are granted at short notice towards the end of the year. Due to this limited visibility characteristic of the TV business, we partly disclaim quantitative forecasts for the planning years 2016 to 2017 below. Instead, we will make qualified, comparative statements; the described degrees of change “slight increase,” “mid single-digit increase,” “mid to high single-digit increase,” “high single-digit increase” and “significant increase” are based on the expected change on the previous year as a percentage.

The disclosures made in the Company Outlook section are based on the planning adopted by the Executive Board and Supervisory Board in February 2016. In addition, our statements are guided by current economic data; these are based on our knowledge at the time of preparation of the report.

Expected Group and Segment Revenue and Earnings Performance

Revenue and earnings forecast 2016 to 2017. We had a positive start to the financial year 2016 in all segments and continue to expect a favorable business and economic climate. In addition to organic growth, revenue growth will be strengthened by additions to the portfolio. ProSiebenSat.1 has budgeted for profitable revenue growth of over EUR 200 million in 2016 in connection with the acquisitions in the past financial year. In total, we expect consolidated revenues to increase by more than ten percent for 2016 against the backdrop of the strengthened M&A activities. In 2017, consolidated revenues are likely to grow by a high single-digit percentage. In addition to ongoing economic stimuli, we base this forecast on the success of our strategy in the TV and digital business. We closed 2015 with revenues of EUR 3.261 billion.

The Group is investing in sustainable growth in all segments and is diversifying its revenue portfolio. The related cost increase will be offset by further high growth in revenues; we therefore forecast EBITDA and recurring EBITDA to increase by a mid to high single-digit percentage in 2016 and 2017. We also expect underlying net income to grow mid to high single-digit percentage in these periods.

For ProSiebenSat.1 as a diversified Group, the priority is to achieve profitable growth and generate the highest possible returns on purchase prices paid for acquisitions. In its TV segment, the Group is growing with a recurring EBITDA margin of more than 30 %; at the same time, the Company is generating a continuously increasing earnings contribution in the Digital & Adjacent and Content Production & Global Sales segments, which have a lower margin profile due to structural reasons. Against this backdrop, we expect a slight decline in the Group earnings margin overall. However, this is likely to remain above average compared to our relevant European peers. The following table provides an overview of the relevant forecast figures for the Group:

Forecast for Group key figures — 2-year view |

||||||||

|

|

|

||||||

EUR m |

2015 |

Forecast1 2016 respectively 2017 |

||||||

|

||||||||

Revenues |

3,260.7 |

Significant increase respectively high single-digit increase |

||||||

EBITDA |

881.1 |

Mid to high single-digit increase |

||||||

Recurring EBITDA |

925.5 |

Mid to high single-digit increase |

||||||

Underlying net income |

467.5 |

Mid to high single-digit increase |

||||||

Leverage2 |

2.12 |

1.5 – 2.5 |

||||||

The ProSiebenSat.1 Group is growing profitably in all three segments; for 2016 and 2017, we expect the following revenue and earnings performance in the segments:

- Broadcasting German-speaking segment: In the TV segment, we want to continue our solid and highly profitable growth. In the next two forecast periods, we therefore expect another slight increase in revenues and earnings. ProSiebenSat.1 Group benefits from the fact that it has successively expanded its complementary station family in the last few years and established a second business model in the form of distribution. In addition to a favorable economic environment, the ongoing structural change is having a positive effect on advertising revenues: Many print customers are moving their advertising budgets to television. The newer stations are capitalizing on their reach increasingly adequately and obtaining new customers for the medium of TV.

- Digital & Adjacent segment: The dynamic growth in the Digital & Adjacent segment is likely to continue: For 2016 and 2017, we are therefore planning another significant revenue increase; revenue growth will lead to a similarly significant increase in recurring EBITDA and EBITDA. We are the leading marketer for video advertising and are successively enlarging our customer base. In this context, we have also identified a new growth prospect in the market for digital out-of-home advertising. At the same time, we want to consolidate our competitive position in attractive digital entertainment markets and further establish and internationalize verticals in the Ventures & Commerce business. This strategy comprises acquisitions and strategic alliances; they make it easier to access new markets and contain additional growth potential.

- Content Production & Global Sales segment: In the Content Production & Global Sales segment, we have used acquisitions in important TV markets such as the US and the UK in recent years to establish ourselves as one of the major players in the production and distribution business. In 2015, Red Arrow further increased its presence in the US, expanded its English-language fiction portfolio and promoted business with digital companies. We will continue this successful strategy; revenues and recurring EBITDA are expected to gain a significant increase in the next two years.

Forecast for segment key figures — 2-year view |

||||||||||

|

|

|

|

|

||||||

|

2015 |

Forecast1 2016 and 2017 |

||||||||

EUR m |

External revenues |

Recurring EBITDA |

External revenues |

Recurring EBITDA |

||||||

|

||||||||||

Broadcasting German-speaking |

2,152.1 |

734.3 |

Slight increase |

Slight increase |

||||||

Digital & Adjacent |

846.4 |

170.2 |

Significant increase |

Significant increase |

||||||

Content Production & Global Sales |

262.2 |

25.0 |

Significant increase |

Significant increase |

||||||

Medium-term revenue and earnings targets. ProSiebenSat.1 has identified the greatest potential and synergy in the interlinking of the high-reach TV offering and its digital activities. The Group is therefore diversifying its business areas and becoming increasingly independent from the seasonality of individual markets, especially the TV advertising market. In the medium term, we are aiming at an even distribution of revenues by 2018 and want to generate around 50 % of revenues outside the TV advertising business.

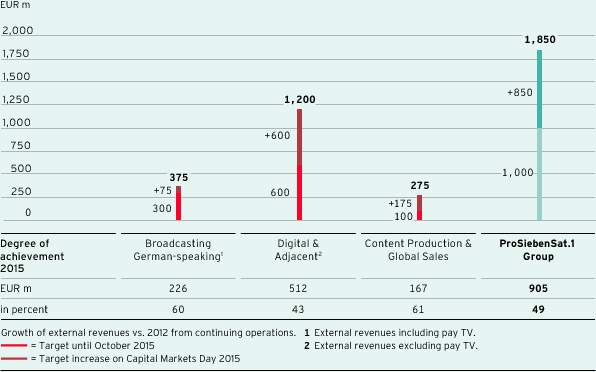

ProSiebenSat.1 has informed the capital market in October 2015 about the new medium-term targets: For 2018, we expect consolidated revenues of EUR 4.2 billion; this is an increase by EUR 1.85 billion compared to 2012. The highest share of growth will be generated by the Digital & Adjacent segment with its very dynamic Ventures & Commerce business. Recurring Group EBITDA is expected to rise by EUR 350 million to nearly EUR 1.1 billion at the same time. These growth targets include the recently acquired majority interests such as in Verivox and etraveli. The graphic below shows an overview of the expected revenue contributions from each segment:

Revenue growth targets 2018 and degree of achievement 2015

Future Financial Position and Performance

As of December 31, 2015, with an equity ratio of 17.7 % and a leverage ratio of 2.1, the Group had an efficient balance sheet and capital structure. The Group optimized its financing further and profited from attractive conditions by extending the duration of the facilities agreement to 2020 and increasing the term loan to EUR 2.100 billion. The Group has good liquidity and financial scope for investments.

The ProSiebenSat.1 Group will continue its multi-station strategy in the TV segment and invest around EUR 900 million a year in programming assets and the expansion of the stations. We will also continue our M&A strategy. With idle advertising inventory worth more than EUR 1.5 billion (gross), we have a second investment currency that allows us to expand our portfolio and build up new brands with capital efficiency and without high cash investment. Despite its M&A activity, the Group will also continue to adhere to its target range for the leverage ratio of 1.5 to 2.5.

The ProSiebenSat.1 Group lets its shareholders participate in the Company’s growth appropriately. We therefore intend to continue our earnings-oriented dividend policy and distribute an annual dividend of 80 % to 90 % of underlying net income. For 2015, we will propose a dividend of EUR 1.80 per common share (previous year: EUR 1.60). This represents an expected payout of EUR 386 million or 82.5 % of underlying net income. This results in an attractive dividend yield of 3.8 % (previous year: 4.6 %) compared to the closing price of the ProSiebenSat.1 share at the end of 2015.