Risk Report

- The overall risk situation is still contained.

- We have an effective risk management system.

Risk Management System

Risk is defined in this report as a potential future development or potential future event that could significantly influence our business situation and result in a negative deviation from targets or forecasts. The risk indicators that we have already taken into account in our financial planning or in the consolidated financial statements as of December 31, 2015, do not therefore come under this definition and are consequently not explained in this Risk Report.

ProSiebenSat.1 Group has established a systematic risk management system. It focuses on the Group’s specific circumstances and covers all activities, products, processes, departments, equity interests and subsidiaries that could have an impact on our Company’s business performance. The new corporate units are systematically included in the risk management system.

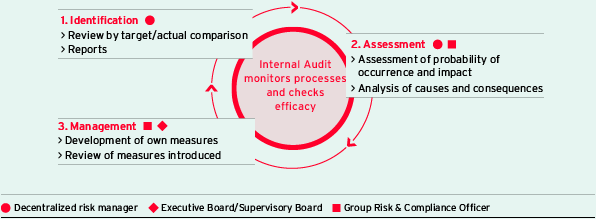

Risk management is divided into the following processing steps:

- Identification: It starts by identifying material risks via a target/actual comparison. The decentralized risk managers are responsible for this. For this purpose, they are guided by early warning indicators defined for relevant circumstances and key figures.

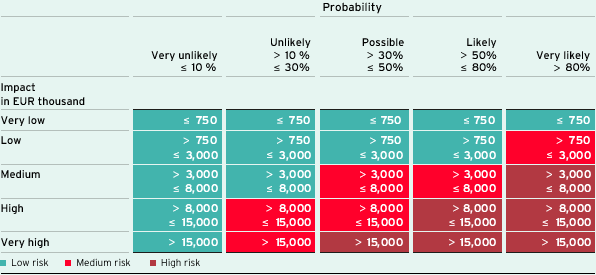

- Assessment: The relevant risks are assessed on the basis of a matrix: First, the circumstances are categorized on a five-step percentage scale in terms of the probability of their occurrence. Second, the extent of their possible financial impact is assessed; the financial equivalents are also divided into five steps. The aim is to classify the risk potential according to its relative significance as “high,” “medium” or “low.” In simplified terms, this risk matrix is as follows:

Risk classification

As well as classification, risk assessment also includes analyzing causes and interactions. Measures to counteract or minimize risks are included in the quantification (net assessment). In order to obtain the most precise view of the risk situation possible, however, opportunities are not taken into account. We record these in budget planning.

- Management: Risk management aims to use appropriate measures to reduce the probability of occurrence of potential losses and to limit or decrease possible losses. Countermeasures are developed and initiated as soon as an indicator reaches a certain tolerance limit.

Risk control completes this processing step. The defined measures and risks are documented and tracked in reports throughout the year.

Risk management process

Clear decision-making structures, standardized guidelines and a methodical approach are a fundamental requirement for secure risk handling across the Group. At the same time, processes and organizational structures must be flexible enough to allow us to respond appropriately to new situations at all times. This is why the regular classification of risks occurs locally, in the various corporate units:

- Decentralized risk managers: The risk managers record the risks from their respective area of responsibility according to the standard Group system described. They document their results in an IT database every quarter.

- Group Risk and Compliance Officer: The Group Risk and Compliance Officer reports the risks documented in the database to the Executive Board and Supervisory Board every quarter. Relevant risks arising at short notice are reported immediately. In this way, the Executive Board and Supervisory Board regularly receive all decisive analyses and data at an early stage in order to be able to respond proactively.

The Risk and Compliance Office supports the various corporate units not only in identifying risk at an early stage. It also ensures the efficacy and timeliness of the system by training the decentralized risk managers and continuously monitoring the scope of risk consolidation.

Moreover, the Internal Audit unit regularly reviews the quality and regularity of the risk management system. It reports the results directly to the Group CFO.

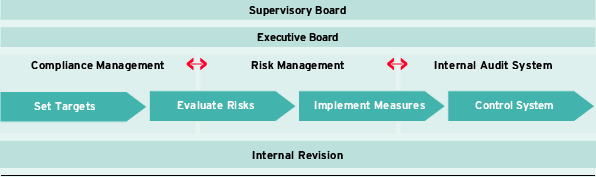

Risk managment system

The audit of the risk management system generated a positive result again in 2015. The system itself did not change in the past financial year. The basis for the audit is the Risk Management Manual. It summarizes company-specific principles and reflects the internationally recognized frameworks for enterprise risk management and internal control systems from COSO (Committee of Sponsoring Organizations of the Treadway Commission).

Development of Risk Clusters

Risk Categories and Overall Risk Situation

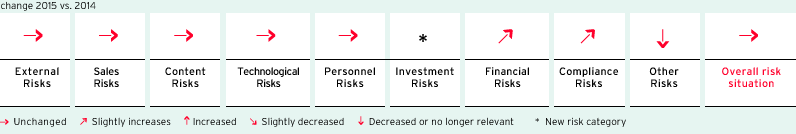

Our overall risk situation remains limited. It is largely unchanged year-on-year, although some of the individual risk clusters have increased or decreased slightly compared to December 31, 2014:

Development of risk clusters and the overall risk situation of the Group as of December 31, 2015

The assessment of the overall risk situation is the result of an aggregate analysis of the Group’s main risk clusters — “operating risks,” “financial risks,” “compliance risks,” and “other risks.” Due to their thematic diversity, we also subdivide operating risks into external risks, sales risks, content risks, technological risks, personnel risks, and investment risks. The main risk clusters comprise various individual risks in turn.

To assess the overall risk situation, we start by classifying all individual risks as part of the quarterly assessment process and aggregate them into clusters. In doing so, we use the matrix described above. The clusters are weighted in turn to reflect their significance for the Group. To make the process easier to understand, descriptions of the individual risks and explanations of their categorization are provided on the following pages. These are not necessarily the only risks that the Group faces. However, we are not currently aware of any additional risks that could impact our business activities, or we consider them as not material.

Operating Risks

Operating risks |

||||||||||

|

|

|

|

|

||||||

|

Impact |

Probability |

Significance |

Changes vs. previous year |

||||||

|

||||||||||

EXTERNAL RISKS |

|

|

|

|

||||||

Macroeconomic risks |

High |

Possible |

Medium |

Unchanged |

||||||

General industry risks (media usage behavior) |

Very high |

Unlikely |

Medium |

Unchanged |

||||||

SALES RISKS |

|

|

|

|

||||||

Media convergence |

High |

Possible |

Medium |

Unchanged |

||||||

Selling advertising time |

Very high |

Unlikely |

Medium |

Unchanged |

||||||

Online advertising: Ad blockers |

High |

Possible |

Medium |

Unchanged |

||||||

Audience shares |

High |

Unlikely |

Medium |

Unchanged |

||||||

CONTENT RISKS |

|

|

|

|

||||||

License purchases |

Medium |

Very unlikely |

Low |

Unchanged |

||||||

Commissioned and in-house productions |

Medium |

Unlikely |

Low |

Unchanged |

||||||

TECHNOLOGICAL RISKS |

|

|

|

|

||||||

Broadcasting equipment and studio operations |

Low |

Unlikely |

Low |

Unchanged |

||||||

IT risks |

Low |

Unlikely |

Low |

Unchanged |

||||||

PERSONNEL RISKS |

|

|

|

|

||||||

|

Medium |

Unlikely |

low |

Unchanged |

||||||

INVESTMENT RISKS |

|

|

|

|

||||||

Risks from majority interests |

Medium |

Unlikely |

Low |

New |

||||||

Risks from minority interests |

Medium |

Unlikely |

Low |

New |

||||||

External Risks

The development on the German TV advertising market is our most important planning assumption. In addition to economic growth, we include industry-specific data such as the high reach of TV in our economic considerations.

Macroeconomic risks. ProSiebenSat.1 analyzes economic and market developments continuously and assesses them systematically as part of risk management. The contractual agreements with our advertising customers are also an important indicator for budget planning and risk assessment.

Growth forecasts by industry experts for the German net TV advertising market are optimistic. This also applies to online advertising, with in-stream videos in particular continuing to rise strongly. We are also expecting a favorable industry environment and base our assumption first on structural change in the German advertising market: TV and online are gaining market share as a result of digitalization, while print advertisements are becoming less relevant. Furthermore, the domestic economy is developing positively overall. In the main revenue market of Germany, advertising spending is likely to increase in parallel.

Economic forecasts naturally entail certain insecurities, which could, depending on their extent, also have an impact on advertising budgets. The short-term nature and seasonality of budget allocation also influence planning security. We have therefore left the risk significance unchanged compared with 2014 and continue to estimate this category as medium risk. We continue to rate high negative consequences from the general economic conditions as possible.

ProSiebenSat.1 pursues a dual growth strategy and is diversifying its risk profile in all segments. Reaching new target groups is a central component in the economically sensitive TV segment. With sixx, it has succeeded, for example, in appealing sufficiently to female viewers, who represent an important target group for the advertising industry, and consequently in releasing additional advertising budgets. At the same time, short-term falls in market share can be offset via the multi-channel portfolio with its complementary channel positioning and compensated at Group level. We are also investing consistently in new growth markets such as HD distribution and consequently also in business areas, which can be funded independently of advertising revenues, in the Broadcasting German-speaking segment. In 2015, the Group already generated 39.5 % of its revenues outside the TV advertising business. In the medium-term, we aspire to a harmonious distribution of revenues; 50 % of revenues are expected to come from sales of TV advertising time.

General industry risks (media usage behavior). Digitalization is accelerating technological change throughout the world and in virtually every industry. Media use is also changing. Thanks to digitalization, today’s transmission routes for video content are far more diverse than they were even a few years ago and offer viewers a range of additional viewing options such as Time Shifted TV or video-on-demand. Among other things, these offerings allow viewers to download films at the time of their choosing or on the go. Regardless of the radio signal, viewers can also follow the TV program that is currently being broadcast online via apps on tablets or smartphones - live wherever they are. However, the new forms of use only account for a small proportion overall: 96 % of TV consumption among viewers aged 14 and over in Germany still takes place via live use at the time of the broadcast.

Overall, digital change is taking place more slowly in Germany than in other countries and is following different patterns. The broad offering of free TV financed by advertising is a structural feature of the German market. Unlike the US or Scandinavian countries, a majority of stations can be received free in Germany and the quality of their programs is high. This is reflected in the number of pay TV and VoD subscriptions. While only 20 % of viewers currently subscribe to pay TV programs in Germany, in the US it is around 85 % of households. VoD offerings are used by 7 % of households in Germany compared with approximately 45 % in the US. Willingness to pay for additional offers is even greater in Scandinavia; market penetration of pay TV stands at 86 % to 96 %.

Television is the most important mass medium in Germany; monthly net reach is stable at a high level. Accordingly, 50 million viewers aged 3 and above watched television on an average day in 2015. At the same time, we assume that video use overall will increase sharply. One reason for this development is the increasing availability of faster and cheaper mobile Internet connections, which will encourage easy use of TV content on smartphones or tablets. In addition, TV content will be distributed via stations’ catch-up services, meaning that we are forecasting that viewers aged between 14 and 49 will use TV content via all platforms and transmission routes for 257 minutes in total in 2020. This figure was 216 minutes in 2015. Of this figure, 176 minutes was attributable to traditional viewing in front of a TV set.

The basic function of TV remains the same. According to the Media Activity Guide, the majority of Germans prefer to watch television in “lean-back mode”; accordingly 70 % of those questioned would like to lean back and relax when watching television. As in 2012, there is therefore at least one TV set in 95 % of German households today. Consequently, the number of sets remains constantly high. However, the sets themselves are developing via technical innovations such as the possibility of receiving HD as well as larger screens — and improving in quality. Patterns of use such as the parallel consumption of TV and Internet are also commonplace; some 45 % of 14- to 49-year-olds often use their smartphones for surfing the Net while watching TV. These market data and research results show that mobile devices are part of everyday media usage, but they are not replacing the TV set. Rather, they are used as second screens and fulfill additional functions such as the online search or communication via social media channels. This form of parallel media use is also influencing the advertising industry, with e-commerce companies benefiting most notably from the interaction of TV and Internet and the advertising impact of TV in Germany increasing further.

Against this backdrop, ProSiebenSat.1 is very well positioned to exploit digital development as an opportunity for growth: The company is the market leader in the German audience market in the advertising-relevant target group of 14 to 49 year old viewers and also offers its station in HD in addition to free TV offerings in SD quality. At the same time, ProSiebenSat.1 developed a digital entertainment offering at an early stage and serves new media usage habits with the online video portal maxdome or the 7TV app. We already reach more than 30 million users via digital services today. By inference, we still consider material risks from a change in media use to be unlikely to materialize. In the event of a fundamental change, however, we cannot completely rule out a very high financial impact on our core business and thus the entire Group. We therefore rate this as a medium risk overall.

Sales Risks

Media convergence. No other technology has spread as quickly in a period of only three years as smartphones and tablets. In 2012, these devices were still a niche product in Germany, today they are practically ubiquitous. This development reflects users’ desire to use media everywhere and, in particular, when traveling. In the process, the once strong ties between content and end devices are coming undone, the boundaries between genres are becoming blurred. Today, radio is also received via Internet, newspapers are read online in many cases. This means that digitalization is encouraging the convergence of media, the same content is now used on various channels on different devices. This development is being driven by broadband Internet connections with fast data transfer rates.

In view of the increasing number of end devices and the resultant increase in digital media offerings, questions are repeatedly asked about the future relevance of traditional television. However, the current results of research by the Media Activity Guide, a comprehensive study carried out by forsa on behalf of the ProSiebenSat.1 advertising sales company SevenOne Media, again reveal a converse picture for Germany. New forms of video use are supplementing television instead of substituting it. Entertainment devices such as smartphones and tablets are, accordingly, used in addition to the TV set. Parallel use is not having an adverse impact on linear television either. Almost all 14- to 49-year-olds use more than one screen medium (96 %). However, people who use several screens are not only more online-savvy. They are also more interested in television and spend 193 minutes every day watching TV. This is three minutes more than the average in their age group. The additional screens are also used to watch TV programs without TV sets. Among viewers aged 14 and above, around 4 % of TV use is attributable to new methods such as live streams or TV sticks connected to PCs and laptops (previous year: Also around 4 %).

Nevertheless, the high market penetration of convergent devices entails risks for ProSiebenSat.1: TV and online may not only be used complementarily and the consumption of video content on more and more new multimedia devices may rise. Convergence may also lead to TV usage falling in future. This could in turn have a negative impact on advertising customers’ willingness to invest and thus negatively affect prices for TV advertising.

Although we are not currently seeing substitution, we believe it is possible that this risk may materialize. Therefore, we cannot rule out high effects on our revenue or earnings performance and continue to classify potential losses from media convergence as medium risk. For this reason, we will continue investing in the expansion of both our TV and digital businesses and making use of possibilities for growth offered by the integration of the two business areas.

Selling advertising time. In 2015, the ProSiebenSat.1 Group extended its lead in the German TV advertising market and moderately increased its prices for advertising space again. Our customer base comprises companies from a wide range of industries. This diversified portfolio helps to compensate for declines in investment in individual sectors. In addition, the ProSiebenSat.1 Group is consistently developing its new customer business. New stations and business models like the sale of free TV advertising space according to the media-for-revenue-share and media-for-equity principle are important growth measures in this context. In this way, the company frees up additional advertising budgets while making efficient use of its own programming and advertising inventory. The medium-term objective is to increase the share of TV advertising in the overall advertising market.

In the vast majority of cases, we do not conclude advertising contracts directly with the advertising companies. Instead, media agencies function as intermediaries, which become direct contract partners for our sales company SevenOne Media GmbH. The market for TV advertising time is characterized by concentrated structures both on the demand and supply side. On the demand side, there are essentially seven large associations of media agencies, which usually consist in turn of many smaller agencies. They are faced on the supply side primarily by the two private broadcasting groups, ProSiebenSat.1 and RTL, and the public television stations. Because of this and the high attractiveness of television and its relevance as the number one medium in the media mix, the business relationship formally concentrated on a few agencies does not give rise to any notable economic risk. Similarly, we have not identified any material default or liquidity risks because of the association structure described above and the short billing cycles of at most one month.

If advertising budgets were to decline, the price level in the selling of advertising time fall or customers default, this could have very high consequences for the Group’s revenue and earnings performance. We are observing a further increase in the intensity of competition on the German advertising market. Nonetheless, we continue to classify risks from marketing our TV advertising time as medium risks and believe they are unlikely to materialize. In order to identify potential losses early, we analyze the competitive environment as well as our advertising revenues and advertising market shares regularly. By comparing projections and actual figures with the corresponding prior-year values, budget deviations can be identified and countermeasures such as cost adjustments or changes in program planning and price policy can be quickly implemented as well.

Online advertising: Ad blockers. In connection with the sale of online advertising, ad blockers represent a sales risk. These programs, often offered as browser plug-ins and now as apps for end devices prevent advertising from being displayed. The ProSiebenSat.1 Group has taken various measures to limit this risk: The company has introduced technical means that can effectively prevent the ad blockers from functioning. At the same time, we are raising our users’ awareness with education campaigns, such as Stromberg-AdUcate. In addition, ProSiebenSat.1 has filed an application for an injunction against the most widespread ad blocker in Germany (AdBlock Plus); the proceedings are currently being held at the Munich Upper Regional Court. However, further spread of ad blockers is possible; this could have a high impact on the success of the online advertising business. Overall, we rate the total risk for the ProSiebenSat.1 Group as a medium risk.

Audience shares. The German TV family closed the year on 29.5 %, which is an increase year-on-year of 0.8 % and at the same time the best audience share in the core market for ten years. Audience shares are an important figure for the management of the Group and at the same time a key indicator for early risk detection. They firstly reflect whether programming meets the taste of the audience. As a result, they measure the appeal of broadcasts and indicate their profitability. Second, they document the reach of an advertising spot and are consequently a means of documenting our performance for our advertising customers. Viewer shares are part of pricing and may therefore also entail sales risks.

Changes in market share are closely monitored and analyzed daily on the basis of data from the Working Group of Television Research (AGF). In this way, we are able to measure the success of our formats and if necessary to take countermeasures at any time. In addition to quantitative analyses, qualitative studies are also an important control instrument. Program research at ProSiebenSat.1 cooperates closely with various institutes on this. ProSiebenSat.1 commissions them to carry out regular telephone and online interviews and group discussions with viewers in Germany. In this way, stations obtain direct feedback from their audience and thus can optimize and further develop their programs on an ongoing basis.

On the basis of these ongoing market analyses, ProSiebenSat.1 Group has built up talents in recent years that are popular and successful with young viewers. At the same time, the Group has established a station portfolio of complementary TV stations that address different core target groups and have specific programming profiles. Possible market share weaknesses at individual TV stations can thus be offset by the others. In the last few months, the newer ProSiebenSat.1 stations, such as SAT.1 Gold or ProSieben MAXX, have continuously increased both their technical reach and their audience market shares. At the same time, the performance of the large stations is stable overall. ProSieben is the market leader in its relevant target group. With shows such as “The Voice of Germany” or “Circus HalliGalli” the station is setting standards and becoming a pioneer in the German programming landscape. It can be assumed that established station brands like ProSieben and SAT.1 will continue to dominate the market due to their name recognition and their image. The fragmentation of previous years was driven in particular by the opportunities of digital distribution. We are now seeing signs that the fragmentation is easing off.

On the basis of these developments, we believe it is unlikely that this risk will materialize. However, a considerable decline in audience market shares could inherently have a high impact on our revenue and earnings performance. We therefore continue to classify this as a medium risk.

Content Risks

Content-specific risks are categorized as low overall. The ProSiebenSat.1 Group has an extensive portfolio of rights, because it works closely with more than 100 renowned licensors. At the same time, Red Arrow is achieving dynamic growth and has, as planned, expanded its portfolio in the Anglo-American region. The aim is to achieve a balance between licensed programming and local productions.

License purchases. Exclusivity and novelty are characteristics of the quality of interesting program formats. Therefore, the ProSiebenSat.1 Group uses exclusive agreements in the form of contractual blocking periods (hold-back clauses) to protect its rights against other licensees and program licensing forms. In order to stay informed about trends and new productions at an early stage, our purchasing department is also in constant dialog with national and international licensors. Nonetheless, we cannot completely rule out future risks from license purchases, but we consider them very unlikely. In this event, a medium impact on our earnings performance would be conceivable. Overall, we classify this as a low risk. We base our assessment on the following issues:

The ProSiebenSat.1 Group is exposed to currency risks when purchasing program licenses, because it acquires many of its feature films and series from the major US studios. The Group limits this risk with derivative financial instruments.

As well as exchange rate fluctuations, price increases could also influence license purchases and therefore our business performance. On the buying market, the company is in competition with other players, including well-funded international competitors with their own VoD platforms based in the US. However, the ProSiebenSat.1 Group has a diversified supplier base and contracts with all major US studios. Apart from close business relationships with licensors, a high purchasing volume and the Group’s strong negotiating position secure exclusive programs on attractive conditions. In addition, programming contracts are often signed some years before production and broadcast. This guarantees our supply of programming in the long term. Nonetheless, the competition for attractive content could intensify further as a result of growing competition from international market participants and new digital offers. In addition, individual purchases are becoming a more frequent necessity, especially for small TV stations, since their programming is very specifically targeted.

Moreover, signing programming contracts early does not have only advantages. It also harbors a certain potential risk with regard to future program formats if their quality and success is not as expected. In this event, it might be necessary to invest in additional programming. To proactively minimize this risk, we therefore only make long-term programming agreements with film studios and production companies with an appropriate reputation and successful track record. In any case, we have also identified a low potential loss in connection with the currently high proportion of US programs on our free TV stations. US formats such as “Navc CIS” or “The Big Bang Theory” are hugely popular and achieve large audience shares in Germany.

Commissioned and in-house productions (local productions). Commissioned and in-house productions are designed specifically for individual stations and thus strengthen the recognition value of a station. Because reference figures such as ratings are sometimes unavailable, the prospects for the success of local formats tend to be less certain than for licensed formats that have already been successful in other countries or in the movie theaters. The ProSiebenSat.1 Group therefore focuses on an individual and generally balanced mix of licensed programs as well as commissioned and in-house productions.

In order to assess the appeal of its in-house productions as reliably as possible, ProSiebenSat.1 conducts intensive market analysis. Researchers accompany the development of new program formats using a wide range of different methods, in many cases as early as the concept or screenplay stage. So-called Real-Time-Response tests (RTR) are a frequently used instrument. They are deployed when initial sequences or a pilot episode are available for new TV programs. When programs are screened, test persons document their response and reactions using a type of remote control, with accuracy down to the second and in real time. Another measure to limit risk is the internal format management process, whereby the program goes through several approval stages from development to implementation in order to ensure quality and success.

Although we believe it is unlikely that risks connected to local productions will materialize, we cannot completely rule out a medium negative impact on our revenue and earnings performance. Overall, we classify this risk as low.

Technological Risks

Ensuring uninterrupted transmission has high priority for the ProSiebenSat.1 Group. This also applies to system failures and data protection. In the light of extensive measures, we continue to classify the technological risks described in more detail below as low. Accordingly, we consider they are unlikely to materialize and their possible effects on the Group’s revenues and earnings performance as low.

Broadcasting equipment and studio operations. Damage to studio and broadcasting equipment can have financial consequences for our core business of TV: In the event of temporary failures or program changes at short notice, advertising customers could make guarantee and goodwill claims. We counter this risk with a comprehensive security plan. Back-up systems guarantee a broadcasting process without interruptions, even in cases of malfunction. The redundancy systems are kept at separate locations, with multifaceted protection and are operable remotely if necessary. The basic infrastructure for the power supply at the Unterföhring location was fully modernized in 2014. Ongoing maintenance and upgrades when needed keep the systems constantly up-to-date. The automation of technical processes contributes to minimizing risk. The ProSiebenSat.1 Group has a digitalized transmission operation and has transferred the content of the TV stations and online offerings to a shared platform. With its digital pool of materials, the Group has not only set the benchmark in the media industry, but has reduced dependency on manual processes. The company has also leveraged time, quality and cost advantages through doing so.

IT risks. The growing complexity of the system architecture presents the Group with various challenges: The Failures of systems, applications, or networks are as much potential risks as violations of data integrity and data confidentiality. At the same time, the constantly rising level of information processing and networking as well as evolving technologies are first increasing complexity in the interplay of people, processes, and technology; second, there is increasing vulnerability within entity-wide information processing. Targeted attacks show that politically, economically, or ideologically motivated groups represent a growing challenge. The Group is therefore implementing an information security management system (ISMS), which ensures structured, risk-based, and comprehensive protection for the Group’s information assets. The effectiveness of the security standards is examined regularly by the Internal Audit department.

Drills of crisis scenarios help to simulate potential weaknesses and further improve the IT system. In order to prevent losses, the Group has multiple computer centers at separate locations, which assume each other’s tasks in the event of a system failure. The ProSiebenSat.1 Group also invests on an ongoing basis in hardware and software, in firewall systems and virus scanners, and establishes various access authorizations and controls. In 2015, the Group again subjected all relevant business applications to extensive tests, which confirmed a good degree of maturity.

In addition, unforeseeable events such as natural disasters, attacks or accidents could also have an adverse impact on production processes. Clear responsibilities and instructions are crucial, especially in an emergency. For this reason, the ProSiebenSat.1 Group has planned measures for dealing with emergencies and established a crisis management organization. For example, a guide to protecting events has been drafted and implemented to protect live events. Evacuations may also be part of these safeguards, as was the case for the transmission of the finale of “Germany’s Next Top Model by Heidi Klum” in May 2015.

Personnel Risks

In the course of digitalization and the expansion of the Ventures division, the need for qualified specialists and managers is rising, particularly in the growth areas of the Group. This is why we have expanded our recruitment program: The number of suitable applicants was considerably improved in terms of quantity and quality through the standardization of the application procedure, an optimized careers site for mobile devices and target-group-specific events.

Competition for talent in the industry is high — targeted appeals for applicants and close relationships with universities are therefore crucial. We also focus on educating our employees and developing their skills in line with requirements. This also includes the targeted recruitment of talented juniors as part of our Group-wide talent management system. The aim is to implement succession planning for key positions at an early stage and ensure that expertise is retained within the Group. At the same time, the Group has continually expanded the in-house ProSiebenSat.1 Academy’s offerings and developed company-specific support programs such as the learning expeditions. In addition, work-life-balance measures and attractive remuneration models generate long-term loyalty on our employees’ part and make ProSiebenSat.1 a preferred employer. This is reflected in HR figures such as the unchanged long average period of employment; the results of our employee survey and various external studies also attest the attractiveness of the ProSiebenSat.1 Group as an employer.

Against this backdrop, we continue to classify personnel-specific risks as low. We cannot exclude personnel risks entirely, however, we consider they are unlikely to materialize; their financial manifestation would be medium at most.

Investment Risks

ProSiebenSat.1 Group practices active portfolio management with various M&A approaches. This includes acquisitions on the basis of taking majority and minority interests. Acquisitions open up new opportunities for growth and increased efficiency, while facilitating access to new markets. At the same time, investments entail risks with potential financial implications. Investments are therefore subject to a continuous monitoring process, which includes testing for impairment. Alongside profitability, majority interests in particular also entail risks with regard to integrating the acquired companies. However, we consider the materialization of risks from majority interests as unlikely. Their potential financial impact would be medium, meaning that we classify this risk as low overall. We also assess risks from investments via a minority interest as unlikely and classify them as low. They can have a medium impact at most. We invest with media services particularly with start-ups, extending our portfolio in this way, also without deploying large amounts of cash and with limited business risk.

Financial Risks

The ProSiebenSat.1 Group uses various financing instruments: In addition to a term loan, the company has access to a revolving credit facility. The bond market provides a further source of finance. We pursue a proactive financing policy and have extended the term of our term loan on attractive conditions during the year and, at the same time, increased the volume in the light of the good conditions on the money market. We ended the year with net financial debt of 1.940 billion; the leverage ratio was at 2.1 and therefore within the target corridor.

The Group is exposed to various financial risks in its operating business and especially due to the borrowings described above. The great share of financial risks is still classified as low. Due to developments on the market, it is only the interest risk which has changed. This classification is shown below, with the following table providing an overview. For more information on the hedging instruments, measurements and sensitivity analyses together with a detailed description of the risk management system in reference to financial instruments, refer also to the notes to the consolidated financial statements.

Financial risks |

||||||||||

|

|

|

|

|

||||||

|

Impact |

Probability |

Significance |

Changes vs. previous year |

||||||

|

||||||||||

Financing Risk |

Very high |

Very unlikely |

Low |

Unchanged |

||||||

Counterparty Risks |

High |

Very unlikely |

Low |

Unchanged |

||||||

Interest rate risks |

Medium |

Possible |

Medium |

Slightly increased |

||||||

Currency risks |

Medium |

Unlikely |

Low |

Unchanged |

||||||

Liquidity risk |

Very high |

Very unlikely |

Low |

Unchanged |

||||||

The assessment and management of financial risks is coordinated centrally. Group Finance & Treasury is responsible for this. The Group unit monitors developments on the markets systematically, from which it deduces potential opportunities and losses and regularly assesses the risk situation; the requisite measures are defined in close collaboration with the Executive Board of ProSiebenSat.1 Media SE. The Finance & Treasury unit is audited annually by Internal Audit as part of risk management. The last audit again generated a positive result and confirmed the efficacy of the system. Principles, tasks, and responsibilities are defined on a Group-wide basis and regulated via binding guidelines for all subsidiaries of the ProSiebenSat.1 Group.

Financing Risk

The optimization of capital efficiency is a key objective of our financing policy. This is why the Group monitors the money and capital markets continuously and assesses developments as part of risk management. A second objective in addition to cost efficiency consists of guaranteeing access to sufficient funding at any time.

The availability of existing borrowing depends in particular on compliance with specific contractual conditions. These include standard market covenants, which are also subject to regular and systematic assessment.

Violations of covenants could have a very high impact on our financial position and earnings performance. However, we see materialization as very unlikely and classify the financing risk as low overall. The financial covenants were complied with once again in 2015; on the basis of our current corporate planning, a violation in the future is not foreseen either.

Counterparty Risks

Counterparty risks could have a high impact on our earnings performance and financial position. However, as in the previous year, due to the measures taken, we rate the probability of the occurrence of counterparty risks as very unlikely and the risk as low overall. The Group concludes finance and treasury transactions exclusively with business partners which meet high credit rating requirements. The profile of counterparties is systematically and continuously monitored in this connection. In addition to monitoring credit standing, ProSiebenSat.1 limits the probability of occurrence of default risks through a broad diversification of its counterparties. The conditions for the conclusion of finance and treasury transactions is governed by uniform regulations across the Group contained in a directive.

Risks from inefficiencies in connection with decreasing interest rates, see Notes, Note 35 „Further notes on financial risk management and financial instruments according to IFRS 7,“.

Interest Rate Risks

We assess the significance of interest risks as medium, and their probability as possible. This increase in the significance of the interest risk compared to the previous year is a result of the current negative interest rate environment. Should this risk materialize, it could have a medium impact on our earnings performance and financial position. ProSiebenSat.1 Group uses interest rate swaps and interest rate options to hedge its variable-interest term loans against increases in interest rates caused by the market. The hedge ratio of interest rates is high; as of December 31, 2015, 78 % of the entire non-current financing portfolio was hedged with interest rate derivatives (previous year: 95 %). In addition — albeit to a far lesser extent — there could also be a negative impact from interest rate trends in connection with cash drawings on the revolving credit facility. However, as of December 31, 2015 and on the previous-year reporting date, the RCF was undrawn.

Interest rate swaps and currency forwards are accounted for as cash flow hedges as part of hedge accounting, more detailed information is presented in Note 35 “Further notes on financial risk management and financial instruments according to IFRS 7.” The ProSiebenSat.1 Group does not use derivative financial instruments for trading purposes; they are used solely to hedge existing risk positions.

Currency Risks

We classify currency risks as low. Risks from currency fluctuations can arise if revenues are generated in a different currency from the related costs or capital expenditure (transaction risk). This is particularly relevant for license purchasing at ProSiebenSat.1: The Company concludes most of its license agreements with production studios in the United States and generally fulfills the financial obligations resulting from these in US dollars. The Group manages this risk by using derivative financial instruments, primarily currency forwards. As of December 31, 2015, the hedge ratio in terms of a seven-year period was at 74.8 %. Because of the high hedge ratio, we rate the impact as medium. At the same time, we believe it is unlikely that this risk will materialize.

Liquidity Risk

The lack of available funds and consequently the ability to service liabilities sufficiently at any time could have very high financial consequences. Liquidity is therefore managed centrally through a cash management system. The expected liquidity headroom serves as an indicator for the early identification of risk. This is calculated and assessed by comparing currently available funds with budgeted figures, taking into account seasonal influences.

At the end of the year, the Group had cash and cash equivalents of EUR 734.4 million (previous year: EUR 470,6 million); in addition, a revolving credit facility in the amount of EUR 600 million guarantees sufficient liquidity. It is therefore very unlikely that risks will arise from liquidity shortfalls. We still rate this category as a low risk.

Disclosures on the internal controlling and risk management system in relation to the (consolidated) reporting process (section 289 no. 5 of the German Commercial Code and section 315 (2) no. 5 of the German Commercial Code) with explanatory notes |

||||

|

||||

The internal controlling and risk management system in relation to the (consolidated) reporting process is intended to ensure that transactions are appropriately reflected in the consolidated financial statements of ProSiebenSat.1 Media SE (prepared in line with the International Financial Reporting Standards, IFRS) and that assets and liabilities are recognized, measured and presented appropriately. This presupposes Group compliance with legal and company regulations. The scope and focus of the implemented systems were defined by the Executive Board to meet the specific needs of the ProSiebenSat.1 Group. They are regularly reviewed and updated as necessary. Nevertheless, even appropriate and properly functioning systems cannot offer any absolute assurance that all risks will be identified and controlled. The company-specific principles and procedures to ensure that the Group‘s single-entity and consolidated reporting is effective and correct are described below. |

||||

Goals of the risk management system in regard to financial reporting processes |

The Executive Board of ProSiebenSat.1 Media SE views the internal controllingsystem with regard to the financial reporting process as an important component of the Group-wide risk management system. Controls are implemented in order to provide an adequate assurance that in spite of the identified risks inherent in recognition, measurement and presentation, the single-entity and consolidated financial statements will be in full compliance with regulations. The principal goals of a risk management system in regard to single-entity and consolidated reporting processes are: |

|||

> |

To identify risks that might jeopardize the goal of providing single-entity and consolidated financial statements and management report that comply with regulations. |

|||

> |

To limit risks that are already known by identifying and implementing appropriate countermeasures. |

|||

> |

To analyze known risks as to their potential influence on the single-entity and consolidated financial statements, and to take these risks duly into account. |

|||

In addition, in the reporting year we updated our process descriptions and our risk control matrices. The focus here was on standardizing the descriptions and establishing effective control mechanisms. These updates combined with regular tests on the basis of samples were part of the PRIME project. Since then, they have been an integrated part of the internal controlling and risk management system in relation to the (consolidated) reporting process. On the basis of the test results there is an assessment of whether the controls are appropriate and effective. Any deficiencies in the controls are eliminated, taking into account their potential impact. |

||||

Structural organization |

> |

The material single-entity financial statements that are incorporated into the consolidated financial statements are prepared using standardized software. |

||

|

> |

The single-entity financial statements are then consolidated to form the consolidated financial statements using modern, highly efficient standardized software. |

||

|

> |

The financial statements of the main individual entities are prepared in compliance with both local financial reporting standards and the Group‘s accounting and reporting manual based on IFRS, which is available via the Group intranet to all employees involved in the reporting process. The individual companies included in the consolidated financial statements provide their financial statements to Group Accounting in a defined format. |

||

|

> |

The financial systems employed are protected with appropriate access authorizations and controls (authorization concepts). |

||

|

> |

The entire Group has a standardized plan of accounting items, which must be followed in recording the various classes of transactions. |

||

|

> |

Certain matters relevant to reporting (e.g. expert opinions with regard to pension provision) are determined with the assistance of external experts. |

||

|

> |

The principal functions of the reporting process — accounting and taxes, controlling, and finance & treasury — are clearly separated. Areas of responsibility are assigned without ambiguity. |

||

|

> |

The departments and other units involved in the reporting process are provided with adequate resources in terms of both quantity and quality. Regular professional training sessions are held to ensure that financial statements are prepared at a consistent and reliable level of quality. |

||

|

> |

An appropriate system of guidelines (e.g. accounting and reporting manual, intercompany transfer pricing guideline, purchasing guideline, travel expense guideline, etc.) has been set up and is updated as necessary. |

||

|

> |

The efficiency of the internal controlling system in regard to processes relevant to financial reporting is reviewed on a sample basis by the Internal Audit unit, which is independent of the process. |

||

Process organization |

> |

For the planning, monitoring, and optimization of the process of compiling the consolidated financial statements, there is a user-friendly web-based tool that includes a detailed calendar and all important activities, milestones, and responsibilities. |

||

|

> |

All activities and milestones are assigned specific deadlines. Compliance with reporting duties and deadlines is monitored centrally by Group Accounting. In all accounting-related processes, controls are implemented such as the separation of functions, the dual-control principle, approval and release procedures, and plausibility testing. |

||

|

> |

Tasks for the preparation of the consolidated financial statements are clearly assigned (e.g. reconciliation of intragroup balances, capital consolidation, monitoring of reporting deadlines and reporting quality with regard to the data of consolidated companies, etc.). Group Accounting is the central point of contact for specific technical questions and complex accounting issues. |

||

|

> |

All material information included in the consolidated financial statements is subjected to extensive systematic validation to ensure the data is complete and reliable. |

||

|

> |

Risks that relate to the (consolidated) accounting process are recorded and monitored continuously as part of the risk management process described in the Risk Report. |

||

Compliance Risks

General Compliance

The objective of compliance is to ensure seamless management at all times and in all respects. Possible violations of legal statutory regulations and reporting obligations, infringements against the German Corporate Governance Code or insufficient transparency in corporate management can jeopardize conformity to the rules. For this reason the ProSiebenSat.1 Group has established a Code of Compliance across the whole group, which provides employees with specific rules of conduct for various professional situations. Another effective measure to prevent possible compliance infringement is staff training on specific topics such as antitrust issues or the correct way to deal with insider information. Employees also receive systematic training on issues such as data protection, antitrust legislation and bribery.

In order to prevent possible infringements, the ProSiebenSat.1 Group also implemented a Compliance Board constituted of legal experts, Internal Audit staff and employees of operating units. The task of the Compliance Board is to identify conceivable illegal actions at an early stage and initiate appropriate countermeasures. Another function of the Compliance Board is to introduce safeguards against possible external threats such as acts of sabotage. For a television group with a high level of public awareness, the issue of company protection is extremely important. For this reason, the ProSiebenSat.1 Group has taken various measures in order to realize comprehensive security of operating equipment. This includes state-of-the-art access control technology and qualified security staff.

The work of the Compliance Board is managed centrally by the Group Risk and Compliance Officer. His task is to keep abreast of legal developments and any changes in international legislation so as to be able to initiate suitable measures in due time. To bolster the Compliance organization, additional decentralized structures have been implemented. Regular exchanges of experience and information about current trends in different corporate areas have reduced the level of risk. The processes were analyzed by an independent consultant. The result of this risk assessment demonstrated that the Compliance processes in place are effective. In respect to implementing current antitrust law, ProSiebenSat.1 was assessed as “best in class.”

In view of our effective compliance structures, we believe it is unlikely that this risk will occur, but cannot completely rule out a medium negative impact on the Group’s earnings performance. Accordingly, we classify the Group’s risk from general compliance as low. As a result, this risk category is unchanged year-on-year.

Other Legal Risks

Regulatory risks. Any unforeseen changes to the regulatory or legal environment could have an impact on individual business activities. The ProSiebenSat.1 Group is exposed in particular to various risks in connection with tightened regulations with regard to advertising, forms of advertising, broadcasting licenses or competitions. The company actively monitors all relevant developments and is in constant contact with the regulators concerned, to ensure that its interests are taken into account as far as possible. Against this backdrop, we rate the occurrence of risk from the regulatory or legal environment as unlikely and classify this risk as low overall. However, we cannot completely rule out a medium negative impact on our earnings performance and, in particular, earnings in the Broadcasting German-speaking segment, if this risk nevertheless materializes.

Changes in tax risks in 2015. In financial year 2015, ProSiebenSat.1 Group reassessed tax risks in connection with share-based payment models that are fulfilled by issuing shares and in connection with open assessment periods in previous tax years that led to an increase in tax expenses in the financial year. We have rated the significance of the risk arising from other discretionary tax matters as low with a possible probability of occurrence and a potentially low impact.

In addition to these regulatory and tax risks, legal disputes can considerably damage our business, our reputation, and our brands as well as cause costs. These include guarantees, injunctions or actions for damages. Financial implications may also arise from a change in a legal opinion or interpretation thereof. The individual risks are categorized below; Note 33 ”Contingent liabilities” in the notes to the consolidated financial statements contains more information.

Compliance risks |

||||||||||||

|

|

|

|

|

|

|||||||

|

Impact |

Probability |

Significance |

Changes vs. previous year |

||||||||

|

||||||||||||

General Compliance |

Medium |

Unlikely |

Low |

Unchanged |

||||||||

OTHER LEGAL RISKS |

|

|

|

|

||||||||

Regulatory risks |

Medium |

Unlikely |

Low |

Unchanged |

||||||||

Claims for disclosure and actions for damages by RTL 2 Fernsehen GmbH & Co. KG and El Cartel Media GmbH & Co. KG |

Medium |

Possible |

Medium |

Unchanged |

||||||||

Section 32a German Copyright Act (“Bestseller”, non fiction) |

Cannot be assessed |

Possible |

Medium |

Unchanged |

||||||||

Tax risks in connection with the disposal of subsidiaries in Sweden: |

|

|

|

|

||||||||

— |

with respect to the Swedish tax authorities |

Very high |

Possible |

High |

Unchanged |

|||||||

— |

with respect to the Dutch tax authorities |

Very high |

Unlikely |

Medium |

Unchanged |

|||||||

Guarantees from the disposal of the Belgian TV activities |

Very high |

Very unlikely |

Low |

Unchanged |

||||||||

Changes to tax risks in 2015 |

Low |

Possible |

Low |

new |

||||||||

Other Risks

Risks in Connection with the Disposed Eastern European Operations

There were still receivables due from the purchasers of units that were sold as part of the disposal of Hungarian and Romanian operations in 2015; these resulted from a purchase price loan and a working capital facility (Hungary) and a deferred purchase price component (Romania). ProSiebenSat.1 Group also granted a bridge loan for the Hungarian operations in 2015. The loans and purchase price receivable were subject to impairment risks during the year in the event that the business operations did not generate sufficient cash funds. The Group also provided guarantees for license agreements between the Hungarian and Romanian television stations and Universal Studios, CBS and Programs for Media totaling EUR 32.5 million. The loans, the purchase price receivable and the guarantees for license agreements due from the purchaser of the Hungarian operation were settled through a resale of the shares. The economic effect therefore took place within the past 2015 financial year. The purchase price receivable from the sale of the Romanian TV station Prima-TV of EUR 3.8 million was impaired in full in 2015. ProSiebenSat.1 Group was released from the guarantees for license agreements against payment. Therefore, the risk no longer applies in relation to the two transactions.