Technical Distribution, Media Consumption and Advertising Impact

The range of transmission routes is becoming more diverse in the wake of the digital transformation, whereby television is gaining in attractiveness thanks to new ways to use it: Examples include digital television in high definition (HD), catch-up television via apps on mobile devices, and video-on-demand (VoD) on large TV screens. The use of these new services goes hand in hand with the expansion of broadband Internet connections and the growing number of satellite households in Germany:

- In 2015, the number of broadband Internet connections exceeded 30 million for the first time. It has therefore tripled within a space of ten years.

- Satellite connections are now available everywhere and are the most important distribution channel for television. The analog satellite signal was switched to digital five years ago. At the end of 2015, 17.07 million households in Germany received their TV programs via satellite (previous year: 17.15 million).

TV households in Germany by delivery technology |

||||||||||||||||

|

|

|

|

|

|

|||||||||||

TV households |

Potential in millions |

Terrestrial |

Cable |

Satellite |

IPTV |

|||||||||||

|

||||||||||||||||

20141 |

36.71 |

1.38 |

16.59 |

17.15 |

1.59 |

|||||||||||

20152 |

37.03 |

1.30 |

16.09 |

17.07 |

2.56 |

|||||||||||

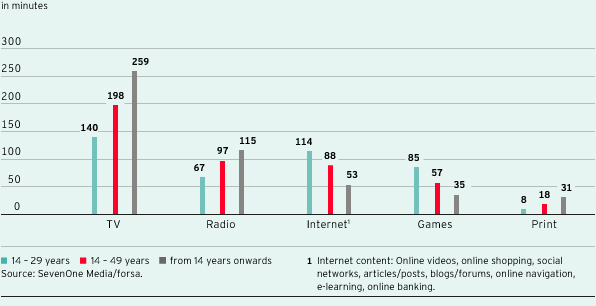

The results of the “Media Activity Guide 2015” study carried out by forsa in March 2015 on behalf of the ProSiebenSat.1 advertising sales company SevenOne Media give a detailed insight into media usage in Germany: On average, people in Germany use media and media transmission channels for 557 minutes every day. Television remains the most popular and highly used medium; viewers aged over 14 years spend nearly half of their daily media use on television. Radio follows in second place with a daily use time of 115 minutes. Content-driven Internet use takes up 53 minutes of the time budget. Print media in particular have declined in importance among the younger target groups: 14- to 49-year-olds now spend 18 minutes per day reading newspapers and magazines.

Average daily use time

The data on television use are collected in Germany via measurement in a TV panel on behalf of the Arbeitsgemeinschaft Fernsehforschung (Working Group of Television Research, AGF). The data show that the time the group of viewers aged over 14 years spent watching television every day increased slightly again in 2015 to 237 minutes (previous year: 234 minutes). This further underscores the importance of TV as the number one medium in Germany. The following trends can be discerned:

- Linear TV consumption dominates the German market; in 2015 it was slightly over three hours per day in the audience group of 14- to 49-year-olds. This is connected to the fact that 70 % of those surveyed see television primarily as a means to relax. So the basic function of television — known as the lean-back function — remains, supported by new services such as three-dimensional HD television. The majority of German households now have an HD-ready television set.

- Television is the most important supplier of video content: While the Internet is firmly incorporated into people’s everyday lives — in 2015, the proportion of Internet users in Germany remained stable at 80 % — 96 % of TV consumption among people over 14 years old still takes place live at the moment of broadcast. Even young media consumers between 14 and 29 years old spend three quarters and thus the majority of their video use time with TV. With average use of over 60 hours per month, private stations are watched the most by viewers aged over 14 years.

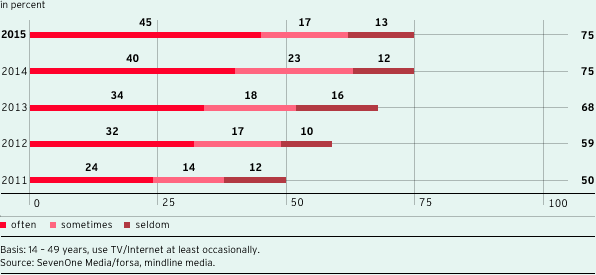

- Everyday media use is characterized by the parallel use of different entertainment devices. Parallel use also stimulates both the use and the advertising impact of TV: People who use multiple screens are not only more Internet-savvy, they are also more interested in TV content and watch 193 minutes of television every day, three minutes more than the average for their age group (14- to 49-year-olds). At the same time, nearly half of all Germans (43 %) have purchased a product online having been prompted by TV content. That is four percentage points more than in the previous year. Around half of all Germans are inspired by TV to research products.

Parallel usage of TV and Internet

Television is the most important mass medium in Germany; on an average day in 2015, 50 million viewers in the age group over three years watched television. Thus, the monthly net reach is stable at a high level. At the same time, digitalization is increasing the relevance of advertising via TV spots compared to other media: TV advertising has the highest impact; no other medium can build up high reach in all target groups so quickly. And this has not changed in the wake of digitalization: According to Nielsen Media Research, the monthly net reach of leading Internet portals such as Google is in Germany only around half as high as that of German private stations. Television advertising is both efficient and effective: Video advertising on TV inspires brand loyalty among consumers and pays off for advertising in both the short and long terms. This is demonstrated by the ”ROI Analyzer,” a study that SevenOne Media published in 2014 together with GfK-Fernsehforschung and the GfK Verein. The study evaluated the effects of TV advertising on all purchase data from 30,000 German households over a year. The results showed that, across all brands investigated, a TV campaign will pay for itself after only one year, with an average return on investment (ROI) of 1.15. This figure increases to 2.65 after five years.

The digital trend has a powerful influence on the media industry. In addition to the opportunities for use, refinancing models are also evolving. Paid services such as pay TV and VoD are also giving ProSiebenSat.1 Group additional growth prospects. Germany is a traditional free TV market, but pay VoD is growing dynamically all the same. At the end of 2015, the volume of the VoD market was EUR 187 million. New markets are emerging at the same time that are suited to TV advertising and are benefiting from the possibilities of the Internet as a distribution channel. For example, the e-commerce market in Germany grew by twelve percent in 2015 to a market volume of EUR 41.7 billion. Looking at the last five years, the market has grown by a total of about 60 % and successively pulled share away from conventional commerce.