Future Business and Industry Environment

- In 2015, private consumption reaches a record level and is also portraying a positive climate for 2016; however, the non-European area continues to entail economic risks.

- The growth forecasts of industry experts for video advertising on TV and in digital media are positive.

- In addition to a good domestic economy, TV in particular benefits from the structural shift in the advertising market, in parallel e-commerce offerings gain relevance in the course of digitalization.

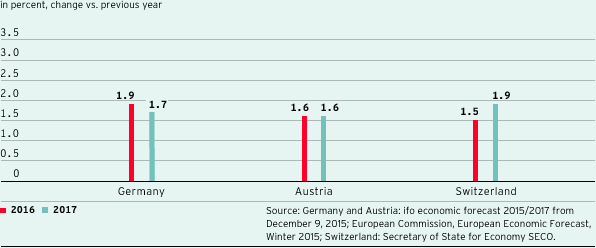

In 2015, the German economy grew by 1.7 %; the prospects for 2016 are similarly positive: The ifo Institute predicts that the gross domestic product (GDP) will grow by 1.9 % in 2016 and 1.7 % in 2017. Private consumer spending, supported by favorable labor market conditions and rising income, is still a significant growth driver. The government is also likely to make a substantial contribution to growth thanks to its sound budget situation. However, the economic weakness of major emerging markets and numerous geopolitical uncertainties are dimming businesses’ export prospects. Export-oriented companies could therefore be less willing to invest despite the still expansionary monetary policy and favorable financing conditions.

For the eurozone, the European Commission anticipates sound growth of 1.7 % in real terms compared to 2015. Alongside an ongoing fall in unemployment, rising incomes and positive effects from the low price of crude oil, private consumption is also likely to be a major driver of the European economy. In addition, the comparatively low exchange rate of the euro against the US dollar may again provide important growth stimuli.

On the other hand, economic experts see risks outside Europe: Besides geopolitical tensions arising in Russia and the Middle East, the economic development in major emerging markets currently entails the greatest risk to the global economy. Above all, the further development of China and the strained economic situation in Russia and Brazil could impact the development of the economy. At the same time, the low price of crude oil strains on the economy of major oil exports. In contrast, the economy in advanced industrial nations such as the US or the eurozone is likely to increase slightly. Against this backdrop, the International Monetary Fund (IMF) expects the global economy to grow by 3.4 % in 2016.

The prospects for the German TV advertising market remain positive. Since its development is closely related to the current and expected general economic situation, the TV advertising market is continuing to benefit from the favorable consumer climate in Germany. With a share in GDP of roughly 54 %, private consumption is the most important macroeconomic expenditure component. It is therefore an important indicator for the TV advertising market as well. In addition to a sound economic environment, the TV advertising market is also benefiting from structural changes: The relevance of TV as an advertising medium is increasing as a result of digitalization; together with online, this category is continuously gaining market share from print. The growth prospects for the German TV advertising market are accordingly positive: With a stable economy and further structural gains, the net German TV advertising market is likely to exceed the previous year’s high level again in 2016. The institutes currently anticipate net growth in the low to mid single-digit percentage range (WARC: +4.3 %, ZenithOptimedia: +2.5 %, Magna Global: +4.3 %). ProSiebenSat.1 expects the market to grow by 2 % to 3 % in net terms. The Group also expects to grow in line with the market over the year as a whole.

The prospects are also positive for digital media: In-stream video advertising is likely to develop dynamically and drive the growth of the online advertising market. For 2016, the institutes anticipate net growth of nearly 8 % (WARC: +7.1 %, ZenithOptimedia: +7.6 %, Magna Global: +7.7 %). Video-on-demand (VoD) will also continue its significant growth. The number of pay-VoD subscribers relevant to ProSiebenSat.1 is expected to grow by an annual average of 140 % by 2018; this equates to a market volume of EUR 575 million. Digital commerce also promises double-digit growth rates in the medium term, as more and more products and services are being purchased online. Digitalization means that not only media consumption but also many other areas of our lives are increasingly shifting onto the Internet. This forms a strong basis for the growth of our digital entertainment and digital commerce offers.

Forecasts for real gross domestic product in countries important for ProSiebenSat.1

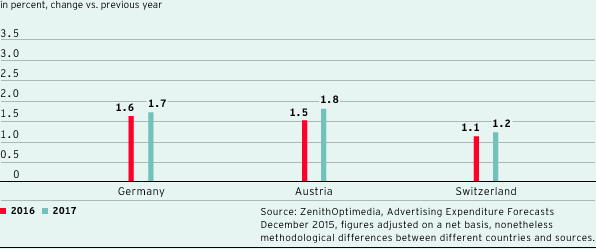

Forecast development of the TV advertising market in countries important for ProSiebenSat.1

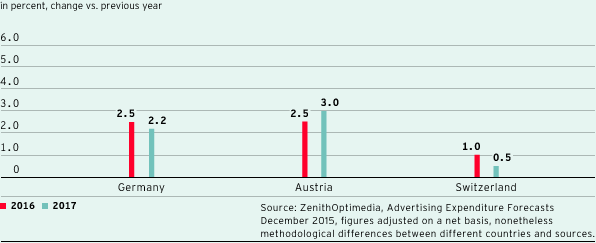

Forecast development of the overall advertising market in countries important for ProSiebenSat.1