Comparison of Actual and Expected Business Performance

- ProSiebenSat.1 makes a new record year and has achieved and in some cases even exceeded all of its financial targets announced for 2015.

- At the same time, the combined market share among viewers aged between 14 and 49 rose to a ten-year high.

- The Group is growing considerably in all segments and has therefore significantly increased its medium-term targets.

Expected Growth in 2015. ProSiebenSat.1 Group publishes its targets in the Annual Report and adjusts them during the year if necessary. Most recently, the Group raised its revenue forecast in October 2015 — from growth by a high single-digit percentage to growth by at least a low double-digit percentage:

In 2015, consolidated revenues increased by 13.4 % to EUR 3.261 billion. As expected, all segments contributed to the profitable revenue growth; over the year as a whole, revenues performed particularly dynamically in the segments Digital & Adjacent (+38.6 % vs. 2014) and Content Production & Global Sales (+29.7 % vs. 2014). The Group’s growth was mostly organic here, but it strengthened its position with acquisitions, too, which substantially sustain the profitable growth. Revenue growth in the Broadcasting German-speaking segment also met expectations at 4.3 %.

Against this backdrop, the operating earnings figures EBITDA, recurring EBITDA and underlying net income increased considerably and reached new record heights. The following table shows a multi-year overview:

Multi-year comparison of revenue and earnings performance |

||||||||||

|

|

|

|

|

|

|||||

EUR m |

2015 |

2014 |

2013 |

2012 |

2011 |

|||||

Revenues |

3,260.7 |

2,875.6 |

2,605.3 |

2,356.2 |

2,199.2 |

|||||

EBITDA |

881.1 |

818.4 |

757.8 |

680.4 |

652.5 |

|||||

Recurring EBITDA |

925.5 |

847.3 |

790.3 |

744.8 |

725.5 |

|||||

Underlying net income |

467.5 |

418.9 |

379.7 |

355.5 |

272.4 |

|||||

The financial position developed as planned in 2015: As of the end of the year, the leverage ratio was 2.1 times. Despite increased M&A measures it thus was within the target range. The Group therefore achieved or slightly exceeded all financial targets announced for 2014.

The most important non-financial parameter of management control is the audience share in the core market of Germany. In 2015, the German station family increased its combined market share to 29.5 % (previous year: 28.7 %); this is the highest figure in ten years. ProSiebenSat.1’s target was to at least maintain or to slightly extend its market lead in a fiercely competitive environment. This target was exceeded significantly.

Comparison of the actual and forecast business performance for the Group1 |

||||||||

|

|

|

|

|

||||

EUR m |

Actual figures 2014 |

Actual figures 2015 |

Change |

Forecast 20152 |

||||

Revenues |

2,875.6 |

3,260.7 |

+13.4 % |

Significant increase 1 |

||||

EBITDA |

818.4 |

881.1 |

+7.7 % |

Mid single-digit increase |

||||

Recurring EBITDA |

847.3 |

925.5 |

+9.2 % |

Mid single-digit increase |

||||

Underlying net income |

418.9 |

467.5 |

+11.6 % |

High single-digit increase |

||||

Leverage |

1.8 |

2.1 |

–/– |

1.5 – 2.5 |

||||

German audience market Market leadership |

28.7 |

29.5 |

+0.8 % pts |

leading position or extend slightly |

||||

Comparison of the actual and forecast business performance for the segments1 |

||||||||||||||||||

|

|

|

|

|

|

|

||||||||||||

|

External Revenues |

Recurring EBITDA |

EBITDA |

|||||||||||||||

in percent |

Forecast2 |

Change |

Forecast |

Change |

Forecast |

Change |

||||||||||||

|

||||||||||||||||||

Broadcasting German-speaking |

Slight increase |

+4.3 % |

Slight increase |

+4.5 % |

–/– |

–/– |

||||||||||||

Digital & Adjacent |

Significant increase |

+38.6 % |

Significant increase |

+31.6 % |

Significant increase |

+20.7 %3 |

||||||||||||

Content Production & Global Sales |

Significant increase |

+29.7 % |

Mid to high single-digit increase |

+30.8 % |

–/– |

–/– |

||||||||||||

Expected Growth in 2018. ProSiebenSat.1 pursues a dual growth strategy and has formulated clear targets for all segments. The Company is targeting a balanced revenue ratio by 2018, when around 50 % of consolidated revenues shall be generated with business models not primarily based on traditional TV advertising. These include revenues from the production and distribution of program content and from e-commerce portals. The Company also generates revenues from pay TV and video-on-demand (VoD) models. The Company advanced the expansion of some of these growth areas faster than expected in 2015, partly as a result of acquisitions. ProSiebenSat.1 achieved record revenues in the Digital & Adjacent segment. At the same time, the Group performed very positively in its core business of advertising-financed free TV and expects a favorable industry environment for TV advertising here in the medium term.

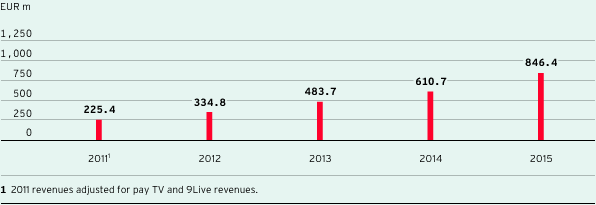

External revenues of Digital & Adjacent segment

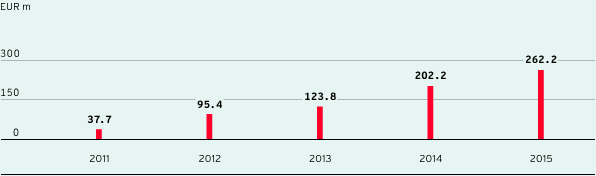

External revenues of Content Production & Global Sales segment

Against this backdrop, the Company has raised its medium-term financial targets for 2018: ProSiebenSat.1 Group is now aiming for revenue growth of EUR 1.85 billion compared to financial year 2012. This is EUR 850 million more than originally expected. Consolidated revenues are thus expected to amount to EUR 4.2 billion in 2018. Recurring EBITDA is expected to rise by EUR 350 million to almost EUR 1.1 billion in the same period. ProSiebenSat.1 had previously aimed for an increase of between EUR 200 million and EUR 250 million compared to the base year 2012. ProSiebenSat.1 informed the capital market of the new medium-term forecast in October 2015. Further information is included in the Company Outlook. As of the end of the year, the Group had achieved 48.9 % of its medium-term revenue target and 51.7 % of its expected recurring EBITDA growth. We are therefore on target.