Major Influencing Factors on Financial Position and Performance

- The economic data paint a positive picture; the growth in the TV business is also driven by structural change.

- Digitalization is changing the economy and society; we are using the digital development and are growing sustainably in all segments.

- The vast majority of our revenue and earnings growth is organic; acquisitions also accelerate our profitable growth.

- ProSiebenSat.1 Group practices proactive financial management and uses attractive conditions on the financial markets.

Impact of General Conditions on the Business Performance

ProSiebenSat.1 Group is constantly diversifying its portfolio, but over half of the increase in consolidated revenues and recurring EBITDA was again based on organic growth in 2015. ProSiebenSat.1’s growth is driven by various factors and external underlying data. In addition to economic conditions, our business performance is influenced by digitalization above all.

The Company generates a large portion of its consolidated revenues from video advertising on TV. In 2015, they amounted to EUR 1,974.1 million (previous year: EUR 1,909.1 million) or 60.5 % of total revenues (previous year: 66.4 %). 88.4 % of this was attributable to Germany, the principal revenue market (previous year: 89.2 %). ProSiebenSat.1 is the leading advertising sales company here and also has the highest reach in the audience market.

Reach is a key criterion for the pricing of advertising and therefore our budget planning. In 2015, the German TV stations achieved their highest market share in the 14 to 49 year old target group in ten years. The Group further increased its market presence particularly among female viewers, who represent an important target group for the advertising industry.

We use audience shares to measure the reach of a TV show; they are therefore an important indicator in the internal management system. General economic and sector-specific data are also relevant to the calculation. Consumer spending by private households increased year-on-year in 2015 and accordingly had a positive effect on the investment decisions of our advertising customers. At the same time, structural changes accelerated market growth and stimulated prices: In comparison to other media, the relevance of TV advertising spots is increasing and gaining market share from print. On the basis of gross data, advertising expenditure for TV increased by 7.0 %. Video advertising is also continuing to gain in digital media; in-stream videos grew by 30.5 % (gross) in 2015.

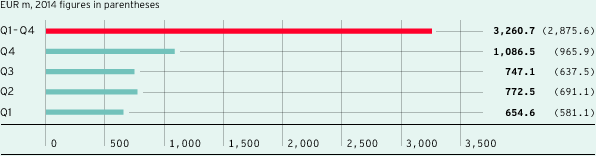

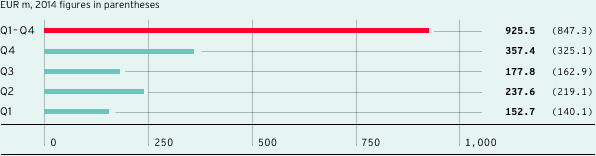

The TV advertising market is growing solidly and supports our profitable revenue growth. Based on their close link to the economic environment, advertising markets react sensitively and often in a procyclical manner to macroeconomic developments. An important indicator in this respect is private consumption in Germany, which rose to a record level in 2015. ProSiebenSat.1 Group’s revenue and earnings performance is also characterized by seasonal effects and especially the great significance of the fourth quarter: As both propensity to spend and television usage increase significantly in the run-up to Christmas, the Company generates a disproportionately high share of its annual TV advertising revenues in the final quarter. In total, the Group generates approximately a third of its annual revenues and usually around 40 % of its recurring EBITDA in the fourth quarter. This was — adjusted for acquisition effects — also true for the past year.

Revenues by quarter

Recurring EBITDA by quarter

ProSiebenSat.1’s aim is to establish additional business models in all segments and to grow more independently of seasonal or economic developments. In the core business, the distribution of TV stations in HD quality is an important factor for becoming more independent of the advertising sector and simultaneously participating in the dynamism of digital markets. The number of HD users increased again in 2015; as a result, ProSiebenSat.1 Group’s distribution revenues developed dynamically. Alongside this, ProSiebenSat.1 Group offers its viewers attractive entertainment online and on-demand and extends its reach with cooperation agreements and acquisitions. In 2015, for example, ProSiebenSat.1 internationalized its MCN portfolio and expanded its digital entertainment offering by acquiring Collective Digital Studio.

The digital entertainment market is growing considerably; we are benefiting from this and, among other things, increased the number of maxdome users in 2015. This change is being driven by broadband Internet connections with fast data transfer rates. Two trends are emerging which are an additional catalyst for our revenue growth: purchase decisions are frequently made online nowadays, so the e-commerce market is growing significantly and has lots of potential. The Internet is establishing itself as a sales channel and is also complemented synergistically by TV advertising. We are therefore systematically expanding our portfolio with e-commerce portals which extend our value chain and are suitable for marketing via video advertising on TV.

While macroeconomic conditions and industry-specific and structural effects can significantly influence our business performance, in some circumstances rising interests have no material impact on the earnings situation. The variable-interest loan liabilities are possibly hedged with various hedging instruments. As of December 31, 2015, the proportion of fixed interest was around 78 % (previous year: 95 %).

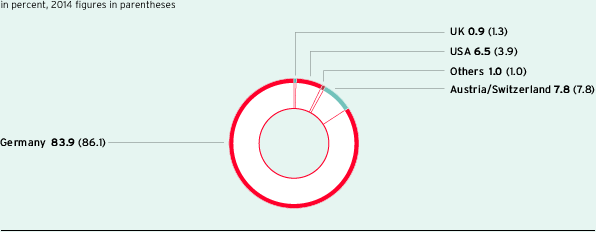

Due to our international business operations, exchange rate fluctuations could affect the Group’s financial situation. Currency effects could especially result from license agreements with US studios. However, the Group limits these currency risks by using derivative financial instruments. In addition, the Company generates the majority of its revenues in Germany and therefore in the eurozone; in 2015, ProSiebenSat.1 Group generated a total of 83.9 % of its revenues in the core market of Germany (previous year: 86.1 %). The remaining revenues were largely attributable to the US and Red Arrow’s production business. Red Arrow significantly expanded its US business in 2015. The changes in the dollar exchange rate against the euro therefore had a positive effect on revenue development in the Content Production & Global Sales segment; the dollar gained in value against the euro over the course of the year.

Revenues by region

Major Events and Changes in the Scope of Consolidation

Conversion into European Stock Corporation (SE)

The conversion of ProSiebenSat.1 Media AG into a European Stock Corporation (Societas Europaea, SE) became effective on July 7, 2015, with its entry in the commercial register. The shareholders had already approved the change in the legal form at the Annual General Meeting on May 21, 2015. The new legal form facilitates the increasing international focus of the Group’s operations and supports its successful growth course.

Changes in the Financing Structure

ProSiebenSat.1 Group practices active financial management and uses the attractive conditions on the financial markets. In April 2015, the Group extended the maturities of its term loan and its revolving credit facility by one year to April 2020. In October 2015, ProSiebenSat.1 also increased the volume of the term loan by EUR 700.0 million to EUR 2.100 billion. The term loan increase serves for general corporate purposes.

Acquisitions and Expansion of the Digital and Production Portfolio

The Group’s digital portfolio grew dynamically in 2015 as a result of M&A activities. The Company pursued different approaches and also made major acquisitions with an international focus. In addition to the units Ventures & Commerce and Digital Entertainment, ProSiebenSat.1 also expanded the US portfolio of Red Arrow. The most important changes in the scope of consolidation are reported below:

- In June 2015, ProSiebenSat.1 Group acquired 80.0 % of the shares in Verivox GmbH via its subsidiary ProSiebenSat.1 Commerce (7Commerce). Verivox is the leading independent consumer portal for energy in Germany. The company has been fully consolidated since August and complements the new e-commerce Vertical of “Online Comparison Portals.” The Comparison Portal vertical also includes moebel.de, 12Auto.de, and Preis24.de, the leading platform for mobile communications tariffs and smartphones. A total of more than 1.5 million deals were made via the comparison portals in 2015.

- In addition, the US company Collective Digital Studio (CDS) was fully consolidated in the Digital & Adjacent segment in the third quarter of 2015. By way of a contract dated June 30, 2015, ProSiebenSat.1 acquired a majority interest in the entity. CDS is a leading multi-channel network (MCN) in the US and complements the Group’s existing online video business: In fall 2013, ProSiebenSat.1 had already established its own MCN in the form of Studio71, which has since established itself as the largest network in the German-speaking region. 100.0 % of the shares in each entity were contributed to a holding company, in which ProSiebenSat.1 holds a 75.0 % stake. This acquisition emphasizes the aim of further strengthening the attractiveness of the digital entertainment portfolio and its international focus. In the context of the transaction, Studio71 and CDS were combined as a global MCN with over 3.5 billion video views per month and more than 350 million subscribers under the Studio71 brand.

- In October 2015, ProSiebenSat.1 also acquired the majority interest in eTRAVELi Holding AB via a subsidiary of ProSieben Travel GmbH (7Travel), thereby internationalizing its activities in the e-commerce business. etraveli has been fully consolidated since December 2015. The Swedish company, headquartered in Uppsala, was established in 2007 and is a leading pan-European online travel agency for flights. The entity operates in 43 countries on four continents with brands such as Supersavertravel, Gotogate, Travelstart and Seat24. In addition, etraveli runs the air fare comparison portals Flygresor.se and Charter.se in Sweden. In October, the flight search engine ueberflieger.de launched in Germany. etraveli is ProSiebenSat.1’s biggest international investment in the commerce sector to date and adds to the travel portfolio of the umbrella brand 7Travel.

- ProSiebenSat.1 also targetedly expanded its portfolio and continued its expansion strategy in the Content Production & Global Sales segment in financial year 2015: In November 2015, Red Arrow Entertainment Group acquired a majority interest in the US production firm Karga Seven Pictures through the acquisition of Crow Magnon, LLC. The company is headquartered in Los Angeles. By making the acquisition, ProSiebenSat.1 is continuing its expansion in the US, the world’s most important TV market. Karga Seven Pictures is already Red Arrow’s sixth investment in the US after Half Yard Productions, Kinetic Content, Nerd TV, Fabrik Entertainment and Left/Right Productions and has been fully consolidated since November 2015.

For more information on current changes in the scope of consolidation, refer to the Notes, Note 7 “Acquisitions and disposals,”.

The following table gives an overview of selected portfolio measures of the Group. Further information on events in the past financial year is available under “The Year 2015 at a Glance.”

Major portfolio measures and changes in the scope of consolidation in financial year 2015 |

||

|

|

|

Segment Broadcasting German-speaking |

Launch of the new free TV station Puls 8 in Switzerland in October 2015 |

|

Segment Digital & Adjacent |

Increase of the majority interest in mydays Holding GmbH, operator of a leading Internet portal for experience gifts in Germany, in January 2015 |

|

|

Founding of ProSiebenSat.1 Commerce GmbH in March 2015 |

|

|

Increase of the investment in Flaconi GmbH, operator of the second-largest online shop for perfume, make-up and cosmetics in Germany, in March 2015 |

|

|

Increase of the investment in Sonoma Internet GmbH, operator of the Internet portal amorelie.de, in March 2015 |

|

|

Majority interest in Virtual Minds AG, a media holding company with specialist companies in the fields of media technologies, digital advertising and hosting, in June 2015 |

|

|

Increase of the investment in SMARTSTREAM.TV, a service provider in the field of online advertising space optimization, in June 2015 |

|

|

Increase of the investment in the US entity Collective Digital Studio (CDS), a leading multi-channel network (MCN) in the US, in June 2015 |

|

|

Majority interest in Verivox GmbH, the leading independent consumer portal for energy in Germany, in June 2015 |

|

|

Majority interest in eTRAVELI Holding AB, a leading pan-European air travel agency, in October 2015 |

|

Segment Content Production & Global Sales |

Founding of the US company Ripple Entertainment, a digital hub in Los Angeles, in July 2015 |

|

Majority interest in the production firm Karga Seven Pictures, a leading US producer and developer of factual entertainment formats, in November 2015 |

||

Major portfolio measures and changes in the scope of consolidation in financial year 2014 |

||

|

|

|

Segment Broadcasting German-speaking |

Launch of the new free TV station ProSieben MAXX Austria in June 2014 |

|

Launch of the new free TV station SAT.1 Gold Österreich in June 2014 |

||

Segment Digital & Adjacent |

Majority interest in COMVEL GmbH, operator of the travel websites weg.de and ferien.de, in January 2014 |

|

|

Founding of ProSiebenSat.1 Travel GmbH in February 2014 |

|

|

Acquisition of the online and mobile games publisher Aeria Games Europe GmbH in April 2014 |

|

|

Increase of the investment in Flaconi GmbH to 47.0 % in July 2014 |

|

|

Increase of the investment in moebel.de Einrichtung & Wohnen AG to 50.1 % in July 2014 |

|

|

Completion of the sale of Magic Internet Musik GmbH in August 2014 |

|

Segment Content Production & Global Sales |

Majority interest in the US production company Half Yard Productions LLC in February 2014 |

|